Choosing the right virtual private network (VPN) service is no simple task. A VPN should keep your internet usage private and secure, but not every service handles your data in the same way. Just look at the critiques of notable computer security experts and online pundits to understand the challenge. Even supposed experts in the field can turn out to be frauds.

Total Pageviews

Tuesday, 17 March 2020

How to watch the UFC 249: Khabib vs. Ferguson livestream with ESPN+ PPV

from Digital Trends https://ift.tt/2W2MLDn

via IFTTT

Internet's largest social networks issue joint statement on COVID-19 misinformation

from Latest news https://ift.tt/3d8PJMW

via IFTTT

NBN to limit maintenance during coronavirus network surge

from Latest news https://ift.tt/2x1zO2a

via IFTTT

Star Wars: The Rise of Skywalker digital release hits early - CNET

from CNET https://ift.tt/3cUWvWt

via IFTTT

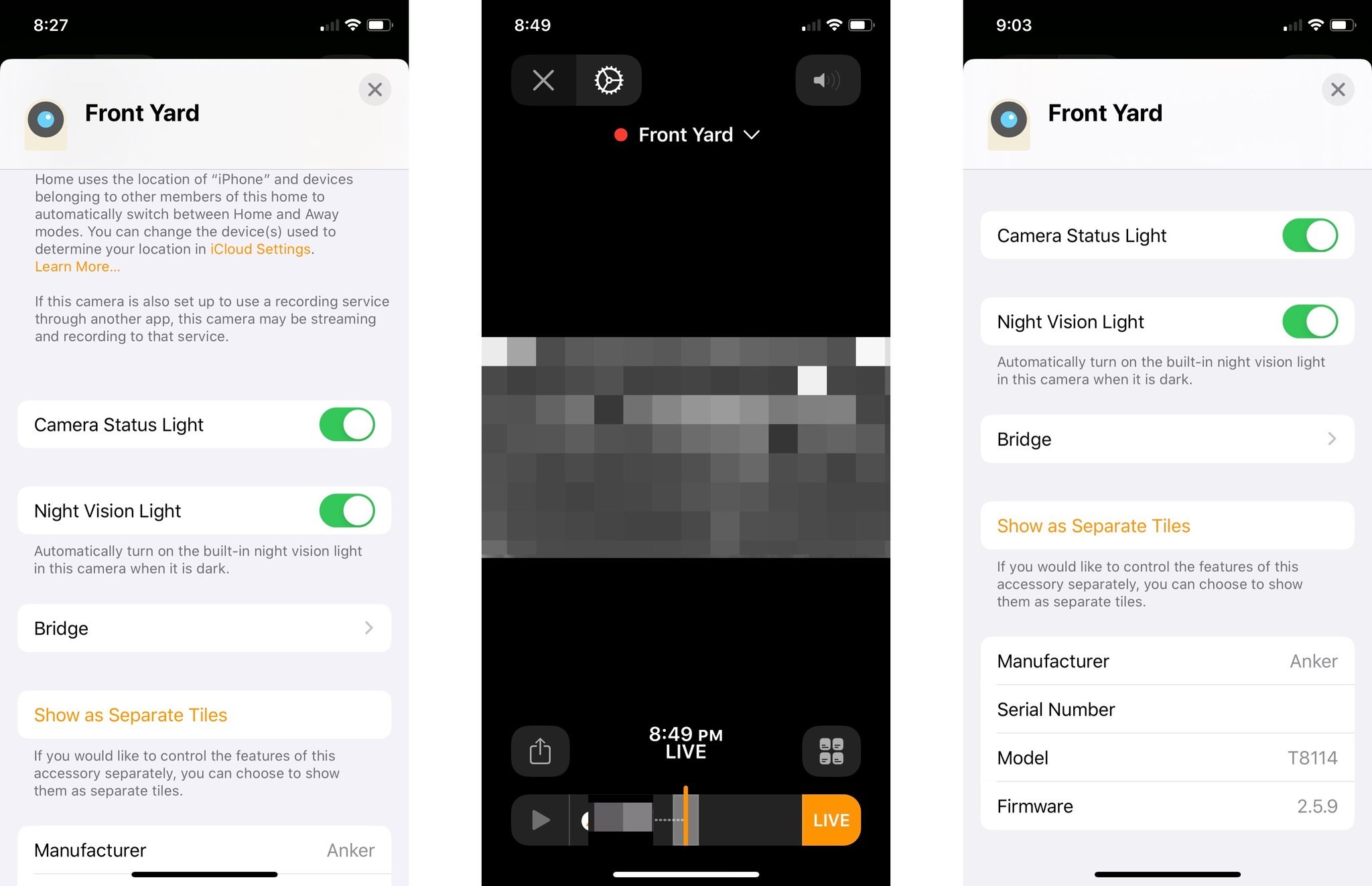

eufyCam 2 update adds support for HomeKit Secure Video

HomeKit Secure Video goes all wireless.

What you need to know

- eufy has quietly updated their eufyCam 2 cameras to support HomeKit Secure Video.

- Update makes the eufyCam 2 the 3rd HomeKit Secure Video camera available.

- The eufyCam 2 is the first and only all wireless HomeKit Secure Video camera on the market.

eufy Security has begun its roll out of firmware updates that brings HomeKit Secure Video support to the company's eufyCam 2 today. The update, which is available for free, adds secure video recording directly to Apple's Home app for users with a paid iCloud storage plan.

eufy's support for the feature was first unveiled on stage during Apple's WWDC 2019 Keynote but did not arrive with the eufyCam 2 when it was released last fall. The update, which is rolling out automatically to eufyCam 2 owners without any prompts, brings the camera up to firmware version 2.5.9. Users can also utilize the firmware update option in the eufy Security app to manually check availability.

eufy has not provided any details regarding the rollout at this time, and its latest app update and release notes do not mention the addition as of yet. It is yet not known whether or not the company's other HomeKit camera, the eufyCam 2C, is getting the upgrade as well.

Secure Video

eufyCam 2

Upgrade to HomeKit Secure Video

The eufyCam 2 is a completely wireless HomeKit camera sytem that is weather resistant and can last up to a full year on a single charge. HomeKit Secure Video support makes one of the best cameras around even better.

from iMore - The #1 iPhone, iPad, and iPod touch blog https://ift.tt/33on4Pb

via IFTTT

Universal making theatrical releases available to rent on iTunes by Friday

Universal wants to get its theatrical releases to you at home.

What you need to know

- Universal Pictures is making theatrical releases available on iTunes this Friday.

- "The Invisible Man", "The Hunt", and "Emma" will all be available.

- Rentals will be watchable for 48 hours and be priced at $19.99.

As the coronavirus pandemic continues to spread across the world, one of the first businesses to be forced to close is movie theaters. In response to the problem, Universal Pictures is taking an unprecedented step.

As reported by Deadline, NBCUniversal's Universal Pictures will be making its current and future theatrical releases available to rent on streaming services like iTunes by this Friday.

Some of the titles currently in theaters include Blumhouse's "The Invisible Man" and "The Hunt", as well as Focus Features' "Emma". All three films are expected to be available to rent on iTunes, Amazon Prime Video, and more. The company is going even further and plans to release "Trolls World Tour" to both theaters and streaming services on April 10th.

The rentals will be available for 48 hours and are currently expected to cost $19.99. While that is a hefty price for a rental, it is still more affordable than going to the theater and the first time a studio has broken the cinematic window in this way.

Jeff Shell, CEO of NBCUniversal, said in a statement that the company is continuing to monitor the changing landscape and adapting its strategy to best serve its audiences.

"Universal Pictures has a broad and diverse range of movies with 2020 being no exception. Rather than delaying these films or releasing them into a challenged distribution landscape, we wanted to provide an option for people to view these titles in the home that is both accessible and affordable ... We hope and believe that people will still go to the movies in theaters where available, but we understand that for people in different areas of the world that is increasingly becoming less possible."

No decisions have been made as to what theatrical films will be available for rent on video-on-demand services after "Trolls World Tour" premieres on April 10th.

from iMore - The #1 iPhone, iPad, and iPod touch blog https://ift.tt/2TThzFg

via IFTTT

Apple employee from Culver City, CA office tests positive for coronavirus

Apple's office in Culver City has been affected by a case.

What you need to know

- An Apple employee in Culver City, California has tested positive for COVID-19.

- The company informed employees of the office in an email on Saturday.

- As of today, the campus remains open.

Over the last week, Apple has made the decision to move its office workers to a remote work environment and close all of its retail stores outside of China for at least two weeks. The measures have been put in place to protect employees and customers from the spread of the coronavirus pandemic.

Unfortunately, one employee from its California offices has tested positive for the virus. Billboard reports that, according to multiple sources, an Apple employee who works at the company's campus in Culver City, California has contracted coronavirus. Employees of the campus were alerted to the situation by email on Saturday.

In a statement to Billboard, Apple confirms that the employee informed the company of their situation and, according to the statement, experienced no symptoms when they were last present in the office. As of today, the Culver City campus remains open.

"A team member in our Culver City office has informed us they tested positive for COVID-19. The individual had no symptoms when they were last in the office, and remains in self isolation at home ... We recognize this is a challenging time for our global community and our thoughts remain with those around the world personally affected by COVID-19 and the heroic medical professionals and researchers fighting it."

Apple's offices continue to undergo "deep cleaning" measures to ward off infection by contact with surfaces, as well as health screenings and temperature checks at all of its corporate locations. Its retail locations remain closed until at least March 27th.

from iMore - The #1 iPhone, iPad, and iPod touch blog https://ift.tt/38SbAoh

via IFTTT

Uber files federal lawsuit against Los Angeles over location data privacy - CNET

from CNET https://ift.tt/2x0tiZG

via IFTTT

Google, other companies get your data if you used Verily's coronavirus site - CNET

from CNET https://ift.tt/3b0ijxV

via IFTTT

Even Spider-Man works from home in this coronavirus-quarantine movie parody - CNET

from CNET https://ift.tt/2IQoCYV

via IFTTT

Google is delaying the launch of its coronavirus information website to later this week

Photo by JIM WATSON/AFP via Getty Images

Photo by JIM WATSON/AFP via Getty Images

Google has made the call to slightly delay the launch of its informational coronavirus website to “later this week.” The site, which the search giant had not planned on making until last week, has been at the center of a swirl of contention between President Donald Trump, Google, and the press since the president first said a site where people could check symptoms, arrange a test, and get test results was coming from Google, but was actually referring to a much more limited site from Google sister company Verily.

Now, a Google spokesperson tells The Verge the company wants to take a little more time to fill out the features of this new informational site. It’s also true that so much has happened in the past 24 hours that Google wanted to...

from The Verge - All Posts https://ift.tt/33orjKF

via IFTTT

Major tech platforms say they’re ‘jointly combating fraud and misinformation’ about COVID-19

Illustration by Alex Castro / The Verge

Illustration by Alex Castro / The Verge

A group of the biggest technology companies in the US say they have banded together in a commitment to fight coronavirus-related fraud and misinformation. The group includes Facebook, Google, LinkedIn, Microsoft, Reddit, Twitter, and YouTube. All seven companies sent out a joint statement Monday evening announcing the effort.

“We are working closely together on COVID-19 response efforts,” the joint statement reads. “We’re helping millions of people stay connected while also jointly combating fraud and misinformation about the virus, elevating authoritative content on our platforms, and sharing critical updates in coordination with government healthcare agencies around the world. We invite other companies to join us as we work to keep...

from The Verge - All Posts https://ift.tt/2vpW31h

via IFTTT

Amazon to hire 100,000 employees to cope with COVID-19 demand

from Latest news https://ift.tt/39Vb9e9

via IFTTT

Roundup: The coronavirus pandemic delivers an array of cyber-security challenges

from Latest news https://ift.tt/2UgGUrs

via IFTTT

HashiCorp soars above $5B valuation in new $175M venture round

The rise of the cloud over the past decade has forced software developers and DevOps engineers to completely rearchitect the modern web application, ensuring scalability, performance, and security. That’s a really painful proposition when done manually, which is where HashiCorp comes in to play. The company’s suite of products helps everyone in the tech workforce from IT admins to software developers operate in the cloud (mostly) effortlessly and natively.

The company’s products have long garnered rave reviews from technical staffs, and now the company is looking at a brand new massive valuation.

The SF-based startup announced today that it has raised $175 million in Series E financing from Franklin Templeton Investments at a scorching $5.1 billion valuation. For context, when we last covered the company back in late 2018, its valuation was only a “paltry” $1.9 billion following a $100 million round led by growth investor IVP.

The company in its release today touted its success in doubling revenues and customers every year for four straight years as the key reason behind the flush valuation. The company is making a (not so) subtle point that David McJannet, who joined the company as CEO in mid-2016 following a stint as an EIR at Greylock, has seen some success in his new role.

HashiCorp CEO David McJannet. Photo via HashiCorp

The company, founded by Mitchell Hashimoto and Armon Dadgar in 2012, is one of the major pioneers in helping companies build high-quality infrastructure that’s a mix of multi-cloud providers, private cloud, and even legacy systems.

It’s most well-known product is Terraform, which allows developers to write repeatable rules around enterprise infrastructure rather than a patchwork of different scripts that might not work as its writers intended. The idea is that with a consistent framework, HashiCorp’s product can help companies reduce costs (by protecting against, say, over-provisioning of resources) while also helping to balance scale and performance. The company’s other products include Consul around network automation, Vault for security, and Nomad for application deployment.

HashiCorp touches on a bunch of competitive products, but its cohesive set of tools and strong outreach to the developer community has set itself apart from the competition in recent years.

Franklin Templeton is a fairly late stage investor that has funded such enterprise companies as Cloudflare, which went public last year, logs management platform SumoLogic, and cybersecurity business Tanium, all according to Crunchbase.

With a hefty $5.1 billion valuation, the company narrowly missed the catastrophic decline of SaaS stocks over the past few weeks, which have been buffeted by the rapidly spreading global pandemic. But with a new war chest and a focus on a popular and growing enterprise market, the company seems poised to continue its growth.

via Startups – TechCrunch https://ift.tt/2UarkxM

Apple Stores in San Francisco Bay Area to stay closed for three weeks

Apple Store customers in the Bay Area are going to have to wait longer than most.

What you need to know

- Apple Stores in the San Francisco Bay Area will stay closed longer than most.

- Six counties in the are declared "shelter in place" mandates until April 7th.

- Only essential businesses will be allowed to remain open during that time.

Last week, Apple announced that it would be closing all of its retail locations outside of China until March 27th in response to the coronavirus pandemic. Now, some stores may have to keep their doors closed for a little longer.

Reported by the San Francisco Chronicle, six counties in the San Francisco Bay Area have issued "shelter in place" mandates, demanding that only essential businesses and services remain open and that all residents in the area stay home except for necessary travel. It is the strictest policy put in place so far in the United States to protect against the spread of coronavirus.

The mandate in all six counties begins at midnight, March 16th and will stay in place until at least April 7th. This new policy will extent Apple's original plan of keeping its retail stores closed until March 27th as many of its stores in the area are located within the counties under the new mandate.

Apple's own headquarters is also in one of the counties now under the mandate, as Apple Park rests within Santa Clara County. Last week, the company asked for employees of the campus to work from home if possible, and this new policy puts even more pressure on that effort.

The new policy set forth by the six counties demands that people work from home unless they provide essential services like public safety, sanitation, and medical services. Businesses such as grocery stores, gas stations, pharmacies, and banks will remain open during the mandate, but others like restaurants will be limited to delivery and take out.

The mandate is currently set to expire on April 7th, but it could be extended once the situation is reevaluated.

from iMore - The #1 iPhone, iPad, and iPod touch blog https://ift.tt/3aZy1te

via IFTTT

WrestleMania 36 relocated by WWE due to coronavirus spread - CNET

from CNET https://ift.tt/39WsN1h

via IFTTT

Fill your home with Wi-Fi using an Orbi tri-band mesh router 3-pack for just $200 - CNET

from CNET https://ift.tt/2QhU3iU

via IFTTT

Braava Robot Mop Deal: Buy now and receive a free gift (and a discount!)

from Digital Trends https://ift.tt/2QnAwxz

via IFTTT

Best VPN services: Reviews and buying advice

from Macworld https://ift.tt/2TBK375

via IFTTT

TransferWise partners with Alipay for international money transfers

TransferWise, the London-headquartered international money transfer service most recently valued by investors at $3.5 billion, has partnered with China’s Aliplay for international transfers.

The launch enables TransferWise’s now 7 million-plus users to be able to send Chinese yuan from 17 currencies to users of Alipay, which serves more than 1.2 billion people worldwide including via its local e-wallet partners.

Promising “instant” money transfers — under 20 seconds, apparently — TransferWise users simply need the recipient’s name and Alipay ID to initiate a money transfer. The money will then be sent to the bank account linked to the recipient’s Alipay profile.

It could be a potentially smart bit of business by TransferWise, which has sometimes struggled to secure the kind of partnerships that can accelerate its customer base and increase transaction volume. According to a 2019 report, the fintech is citing, China is projected to be one of the top remittance recipient countries in the world, with £54bn expected to be sent back home by Chinese expats and migrants living abroad.

“The partnership is a major expansion for TransferWise as it reaches a new, additional market of people managing their money via the Alipay platform,” says the company.

With that said, Alipay is the second meaningful partnership that TransferWise has announced in the last few months. In November, it joined forces with GoCardless, the London fintech that lets customers pay via recurring bank payments (known as Direct Debits in the U.K.). GoCardless is used by more than 50,000 businesses worldwide, spanning multinational corporations to SMBs, and the partnership sees its own FX functionality powered by TransferWise.

via Startups – TechCrunch https://ift.tt/33p8iYC

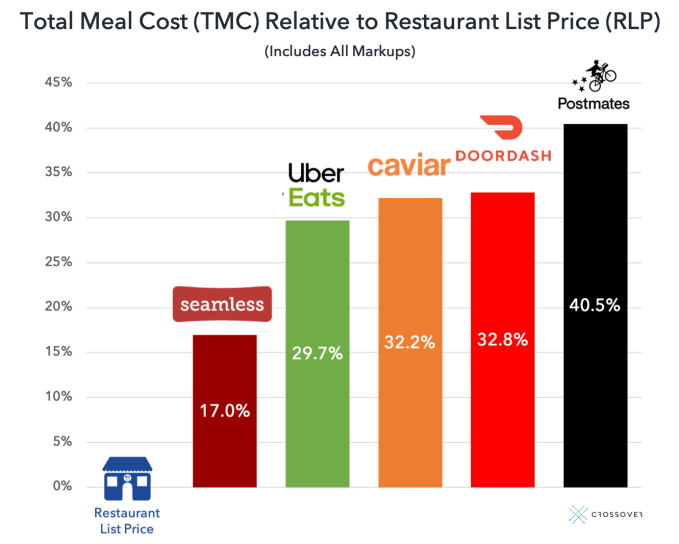

The hidden cost of food delivery

I’ll admit it: When it comes to food, I’m lazy.

There are dozens of great dining options within a few blocks of my home, yet I still end up ordering food through delivery apps four or five times per week. With the growing coronavirus pandemic closing restaurants and consumers self-isolating, it is likely we will see a spike in food delivery much like the 20% jump China reported during the peak of its crisis.

With the food delivery sector rocketing toward a projected $365 billion by the end of the decade, I’m clearly not the only one turning to delivery apps even before the pandemic hit. Thanks to technology (and VC funding) we can get a ride, laundry service, car wash and even booze or marijuana delivered to our home or office at the push of a button. And the implicit trade-off we all make as consumers is that we are willing to pay a little extra for the convenience of having things delivered to our doorstep.

But while consumers have signed on to pay a premium for convenience, the food delivery ecosystem suffers from a lack of differentiation, compounded by an opaque and confusing web of markups and fees. In their quest to achieve profitability, today’s leading food delivery apps have thus far focused their innovation around new ways to charge consumers for the same items instead of innovating on differentiated products or services. Aside from a handful of exclusive delivery partnerships with a few premium restaurants, consumers are instead faced with a delivery market where the services are virtually indistinguishable, yet the price they pay for exact same item from the exact same restaurant can vary by 20% or more depending on the app they use.

Over the past decade we have seen a new wave of industry-leading technology companies emerge by focusing on innovation in otherwise commoditized markets, from financial services to consumer products. Buying stocks? Ordering a razor? Getting a prescription filled? From Robinhood to Dollar Shave Club to PillPack and beyond, today’s leading consumer companies have won through innovation and pricing transparency.

Competition between delivery companies with billions in funding is fierce, and with so much of that capital going toward chasing top-line growth through promos, discounts and other give-aways, innovation on core product has fallen by the wayside. In spite of the billions already invested into the food delivery sector by venture capitalists and massive growth projected in the years ahead, we believe that the industry is still in its infancy, and remains ripe for innovation. The ultimate winners will be those companies that achieve profitability and market leadership through the delivery of not just food, but better products, better services and transparent pricing.

Food delivery: The pricing matrix

To understand how the food delivery ecosystem prices the same items from the same restaurants so differently, we decided to do some research to see if we could shed some light on what you’re really paying for when you open that delivery app.

Before diving into the data, first let’s set the stage. The biggest names in food delivery apps in the U.S. are DoorDash, Uber Eats, Postmates and Grubhub (which owns Seamless). For the purposes of this analysis, we also decided to add Caviar to the mix — a more “premium” option available in larger markets that was sold to Square in 2014 and is now owned by DoorDash.

Next, let’s break down how pricing works. The core components of pricing across all food delivery apps are:

- Menu item: the actual food you are ordering

- Service fee: a fee charged by the delivery company for providing the service

- Taxes: sales tax on your order based on applicable local tax laws

- Delivery fee: the price for having the food delivered

- Gratuity: this is the optional tip for the delivery driver*

*Because gratuity is optional and not tied to any specific delivery service, we excluded it from the data set.

Process

Next, over several days in December we randomly selected 10 restaurants each in Los Angeles, New York and San Francisco that were available on at least four of the five apps and selected the same menu item for delivery to the exact same address. We compiled all data over a 48-hour span and tried to compare pricing for each restaurant/food item combo as close to the same time of day as possible. We then broke down all pricing by the individual components and put the line-item data into a spreadsheet for comparison (link to raw data set shared at the bottom).

Finally, to help clarify the differences in pricing, we introduced a new metric called Total Meal Cost (TMC) to refer to the overall amount it costs to order a meal through a delivery app, compared with ordering that same meal directly from the restaurant. We will refer to the cost when ordering directly from a restaurant as the Restaurant List Price (RLP).

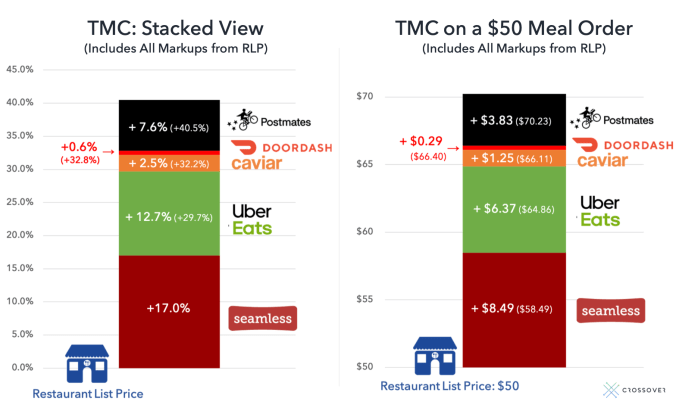

So without further ado, here’s what we learned: While as consumers we expect to pay a premium for the convenience of the service, it turns out there can be a very significant difference between both the price you would pay when ordering directly from a restaurant, as well as what each of the delivery apps charge for the exact same item. When accounting for TMC, on the low end of the spectrum you’d pay an extra 17% over RLP when ordering via Seamless, while on the high end you would shell out a whopping 40.5% more when using Postmates.

To put the markups in further context, if you ordered $50 worth of food from a restaurant, the TMC would come to $58.49 through Seamless compared with $70.23 if you order through Postmates. The graphic below demonstrates how all the apps stack up.

In addition to looking at the overall TMC, we also wanted to zoom in on the data so we could better understand how each of its components — service fees, delivery and even taxes — compare. From a pricing perspective, it seems natural that delivery fees would have the most variability. We’ve all been trained by Uber and Lyft to understand supply and demand and that during busy times delivery can be more expensive (aka everyone’s favorite, “surge pricing”). So while money is money and delivery cost certainly matters, we wanted to also look at how the markup of each component of the TMC differs across the various apps. You can see the summary data below.

One of the biggest take-aways is that Seamless’ comparative price advantage is largely driven by its low service fees. In fact, in 21 of the 28 data points available for Seamless, the company charged no service fee at all. Uber Eats’ comparative advantage is driven primarily by its low delivery fees — likely the result of having an established fleet of drivers and logistics expertise derived from the company’s core ride-hailing business. This offsets their highest comparative markup of menu-item list price. Postmates gets the triple-whammy of high markup, high service fee and high delivery fee. Caviar generally huddles in the middle of the pack on all variables, though its service fee is pretty hefty for Los Angeles residents, at 18%. DoorDash falls victim to its delivery fees, which as the highest in the batch undermine their comparatively low menu markups and service fees.

Other observations

In addition to the high-level take-aways, a few other things we found interesting in the data:

- Meal price markups over RLP in the delivery apps vary by city. On average across all five delivery apps, Los Angeles was marked up the most (6.49%), followed by San Francisco (5.98%), then New York (1.77%)

- Service fees:

- Different Approaches. Uber Eats and DoorDash are consistent in their service fee pricing being pegged to 15% and 11%, respectively. Seamless does not typically charge a service fee. Caviar and Postmates are less clear and consistent on their service fees, though Caviar has a cap of 18%.

- Service fee fluctuation by market. Service fees hold steady across the three surveyed markets for Uber Eats, DoorDash and Seamless, while fluctuating up to 3% across Postmates and Caviar.

- Delivery fee fluctuation by market. On average across the five delivery apps, San Francisco has the most expensive delivery fees ($2.58), followed by New York ($2.08), then Los Angeles ($1.88).

- Other Fees:

- Postmates “Merchant Fees.” In three of the 29 restaurants surveyed that Postmates serves, the company tucked a $1.00 “Merchant Fee” into the Service Fee section, where other delivery apps did not.

- Other Fees. Depending on the market, some restaurants charge a small “bag fee,” which most apps typically fold into the service fee. This is mostly why Uber Eats and DoorDash service fees aren’t exactly 15% and 11%, respectively. Additionally, several charge “minimum” order fees.

- Market share: We didn’t dive specifically into the number of restaurant options available per service per market — that would warrant an entire study in its own right. But other publications have done solid research comparing relative market share, and for the purposes of this analysis, each of the delivery services offered no shortage of options across cuisines.

A quick note on taxes

Taxes charged by the five delivery apps actually showed some variance, as well, and there is significant legal debate currently around how taxes should be calculated. That’s a whole separate article in itself, so we will leave that to the legal experts, as tax rate fluctuation across the apps was 1.1% or less. But it’s still fascinating that with billions of dollars of transactions flowing through these apps, the tax question still remains unanswered.

It’s not just the delivery apps

It’s worth noting that the TMC markup over RLP that consumers experience isn’t entirely at the hands of the delivery services. We spoke with several restaurants about their delivery partnerships and best practices, and several noted that even though delivery partners strongly discourage doing so, they often elect to increase on-app list prices when selling through delivery apps as a way of offsetting the up to 30% fee the delivery apps charge. And while we have not seen any egregious examples of menu pricing markups, in talking with several restaurant owners we were surprised to learn that the delivery companies themselves often list restaurants they have no formal relationship with. The restaurants don’t have to pay them a fee, but as one restaurant owner told us, “Yes, theoretically any non-partner app could list one of our salads for $4,000” and any added profit would go entirely to the delivery service, much like a concert ticket scalper earns profit that doesn’t go back to the artist or event producer.

“Differentiation” today

The Exclusivity Land Grab

As noted above, the primary differentiation between delivery apps today is not based on innovations that meaningfully impact user experience, but instead comes down to a handful of restaurant brands with which the various apps are in a land grab to create exclusive delivery relationships. For example, Postmates has the trendy Sugarfish sushi in Los Angeles, Uber Eats had McDonald’s (until the chain recently added DoorDash), Caviar has local San Francisco favorite Souvla and DoorDash has Outback Steakhouse. While this strategy may help for those users that order religiously from these restaurants, reports suggest that the national chain deals are coming at a major cost to the delivery companies.

Memberships

The other “innovation” focus for some of the delivery services today is a focus on pushing users toward their respective loyalty plans as a way of locking in more predictable revenue and creating brand loyalty in an otherwise commoditized offering. These plans generally include a monthly fee in exchange for no delivery fee for orders above a certain minimum, and include Postmates Unlimited ($9.99/month or $99/year), DashPass from DoorDash ($9.99/month + tie-in for Caviar) and Uber offers a rewards program that works across Eats, rides, bikes and scooters.

Opportunity to innovate

Getting millions of meals delivered quickly, accurately and still warm (or cold) from restaurants to consumers each day is no easy feat. Continually improving the core logistics associated with this undertaking requires massive funding and ongoing investment. You can only play phone tag with your delivery driver and receive a soggy Egg McMuffin so many times before you give up on paying a premium for the convenience. That said, delivery apps must equally invest in consumer-facing innovations if they want to build sustainable brands and reach profitability.

There are far better product minds who can opine on the best ways to innovate on the delivery app experience, but a few examples of features we came up with after consulting fellow delivery addicts include:

- Personalization: Instead of today’s rudimentary search functions, apps that learn “he is lactose intolerant” or “she hates tomatoes” and use AI to improve both search and meal recommendations.

- Multi-location ordering (e.g. sushi and pizza in the same order), which will be further enabled through the growth of multi-tenant virtual kitchens (see below).

- Revamped packaging: Keep hot items hot and cold items cold while exploring more eco-friendly options that save money and the environment.

- One-tap order button for your most-frequently ordered meals.

- Customization: The ability to better support options beyond the confines of a fixed menu — the infrastructure to support “create your own” at scale and provide data back to restaurants to influence ongoing menu development.

- Pictures and reviews: Delivery apps should be able to better leverage their millions of users to collect more data from customers than restaurant-level reviews. The apps that better harness item-level reviews, imagery and similar data will make it harder for others to keep up.

- Premium offerings: Similar to choosing Uber Black, users can pay extra for premium service, such as rush orders that skip the line or setting the expectation that the delivery driver brings items to your front door (versus curbside).

- Diet and nutrition: Better nutritional data and search functionality (such as searching by calories or Keto), as well as integration with health and fitness-tracking apps and popular diet plans.

- Social feed: This may be a stretch, but a social feed of orders among your personal network, similar to Venmo or Snackpass — with integrated gifting.

- Rewards: Other than Uber’s platform-wide rewards program, apps have yet to effectively tap into the power of loyalty and rewards, both at the app level and as a service to be offered at the restaurant level.

Conclusion

So what does it all mean? Well, it’s no secret that companies in the on-demand economy are still struggling to figure out how to make the economics work as both public and private investors become increasingly impatient. In the meantime, the push for profitability has also resulted in questionable labor practices, such as DoorDash applying tips toward its delivery workers’ wages, effectively asking customers to subsidize the wages so the company didn’t have to pay their workers their guaranteed delivery minimum out of pocket (a practice the company has since reversed after public outcry).

As the on-demand food delivery economy continues to hurtle toward a projected $385 billion by 2030, it has also begun to reshape the global restaurant industry. As more and more consumers opt (or are ordered) to stay home and press a button for food instead of going out, restaurant owners are increasingly choosing to forgo expensive real estate and front-of-house staff, and are instead expanding into virtual kitchens that cater exclusively to the on-demand audience. This transition from traditional to “virtual” restaurants may prove to be one of the defining platform shifts of our time, and the venture community has taken note. As the virtual kitchen market grows, so too will the demand for the apps that get the food from the delivery-only commercial kitchens to consumers.

As the battle for market share and profitability heats up in the new wild west of food, consumers have demonstrated they are willing to accept the implicit trade-off of paying a premium for convenience. But as this industry pushes forward toward profitability and sustainable operations, we believe that the companies that embrace transparency and innovate on the core product and service — not on pricing markups and services fees — will emerge as the winners in the new food economy.

Now, what should I order for dinner tonight… and better yet, which app do I use?

Notes

- With only 30 data points per company, a single outlier can skew the data. That said, we believe the data set is sufficient to support our core takeaways.

- The same address was used for all orders in each city.

- All data was pulled in a 48 hour weekday period and at approximately the same time of day.

- Some apps offer a form of membership plan where delivery fees are waived in exchange for a paid membership fee. All data here excludes any special membership programs.

- Promos, specials, or any other discounts were excluded from the data set — if a promo was auto-applied, the original price was used.

- No “surge” pricing was used in any of the delivery fee data.

- All of the apps have “preferred” relationships with a subset of restaurants. This was not factored into the data set.

- The full data set can be accessed here.

Thanks to Josh Elman, Blake Ross, Jesse Lichtenstein, Jared Morgenstern, Roylene Kralich, Nicolas Bernadi and Sam Kokin for their help on this post.

via Startups – TechCrunch https://ift.tt/2UeORxh