Total Pageviews

Monday, 22 April 2019

Weed tech heats up with a new smart vaporizer from Apple, Microsoft alums - CNET

from CNET Smart Home https://cnet.co/2IxxrIR

via IFTTT

Save on First Alert Smoke Detector and Carbon Monoxide Detector Alarm | Battery Operated, SCO5CN and more - CNET

from CNET Smart Home https://cnet.co/2ve135r

via IFTTT

Get a 4-pack of Wi-Fi smart outlets for $18 - CNET

from CNET Smart Home https://cnet.co/2ID95wK

via IFTTT

Save up to 15% off select SUNEON LED Light Bulbs - CNET

from CNET Smart Home https://cnet.co/2PhVdcu

via IFTTT

Amazon launches free, ad-supported music service for Alexa devices - CNET

from CNET Smart Home https://cnet.co/2vciWBS

via IFTTT

You can now play YouTube Music on your Google Home for free - CNET

from CNET Smart Home https://cnet.co/2VOMUaI

via IFTTT

Video Baby Monitor - CNET

from CNET Smart Home https://cnet.co/2VaKmXc

via IFTTT

Save on Smartsense by Sengled PAR38 1 Pack - 3000K LED Security Floodlight with Built-in Motion Detector, Indoor/Outdoor Use, Weatherproof and more - CNET

from CNET Smart Home https://cnet.co/2VQZyWL

via IFTTT

Save on Withings / Nokia | Body+ - Smart Body Composition Wi-Fi Digital Scale with smartphone app, Black and more - CNET

from CNET Smart Home https://cnet.co/2Dlh4Ll

via IFTTT

SimpliSafe + Free Camera - CNET

from CNET Smart Home https://cnet.co/2XpPDI3

via IFTTT

Mirror review: Master home workouts with the Mirror - CNET

from CNET Smart Home https://cnet.co/2AOzrad

via IFTTT

Punny SUVs at the NY Auto Show and More Car News This Week

from Feed: All Latest http://bit.ly/2vhc4CZ

via IFTTT

A Blazing Hot Coal Seam Shows How Microbes Can Spring to Life

from Feed: All Latest http://bit.ly/2XptmKm

via IFTTT

AI Could Predict Death. But What If the Algorithm Is Biased?

from Feed: All Latest http://bit.ly/2Iz0HiD

via IFTTT

Hackers Can Tell What Netflix 'Bandersnatch' Choices You Make

from Feed: All Latest http://bit.ly/2GuGBCr

via IFTTT

How to Watch 'Game of Thrones' Online

from Feed: All Latest http://bit.ly/2UOjGw8

via IFTTT

From lab-grown meat to fermented fungus, here’s what corporate food VCs are serving up

In a foodie’s ideal world, we’d all eat healthy, minimally processed cuisine sourced from artisanal farmers, bakers and chefs.

In the real world, however, most of us derive the lion’s share of calories from edibles supplied by a handful of giant food conglomerates. As such, the ingredients and processing techniques they favor have an outsized impact on our daily diets.

With this in mind, Crunchbase News decided to take a look at corporate food VCs and the startups they are backing to see what their dealmaking might say about our snacking future. We put together a list of venture funds operated by some of the larger food and beverage producers, covering literally everything from soup to nuts (plus lunch meat and soda, too!).

Like their corporate backers, startups funded by “Big Food” are a diverse bunch. Recent funding recipients are pursuing endeavors ranging from alternative protein to biospectral imaging to fermented fungus. But if one were to pinpoint an overarching trend, it might be a shift away from cost savings to consumer-friendliness.

“You think of food-tech and ag-tech 1.0, these were technologies that were primarily beneficial to the producers,” said Rob LeClerc, founding partner at AgFunder, an agrifood investor network. “This new generation of companies are really more focused on what does the consumer want.”

And what does the consumer want? This particular consumer would currently like a zero calorie hot fudge sundae. More broadly, however, the general trends LeClerc sees call for food that is healthier, tastier, nutrient-dense, satiating, ethically sourced and less environmentally impactful.

Below, we look at some of the trends in more detail, including funded companies, active investors and the up-and-coming edibles.

The new, new protein

Mass-market foods may get better but also weirder. This is particularly true for one of the more consistently hot areas of food-tech investment: alternative protein.

Demand for protein-rich foods, combined with ethical concerns about consuming animal products, has, for a number of years, led investors to startups offering meaty tasting tidbits sourced from the plant world.

But lately, corporate food giants have been looking farther beyond soy and peas. Lab-grown meat, once an oddball endeavor good for headlines about $1,000 meatballs, has been attracting serious cash. Since last year, at least two companies in the space have closed rounds backed by Tyson Ventures, the VC arm of the largest U.S. meat producer. They include pricey meatball maker Memphis Meats (actually based in California), which raised $20 million, and Israel-based Future Meat Technologies, a biotech startup working on animal-free meat, which secured $2 million.

Much of the early enthusiasm for new products stems from disillusionment with the existing ingredients we overeat.

If you cringe at the notion of lab-grown cell meat, then there’s always the option of getting your protein through microbes in volcanic springs. That’s the general aim of Sustainable Bioproducts, a startup that raised $33 million in Series A funding from backers including ADM and Danone Manifesto Ventures. The Chicago company’s technology for making edible protein emerged out of research into extremophile organisms in Yellowstone National Park’s volcanic springs.

Meanwhile, if you hanker for real dairy milk but don’t want to trouble cows, another startup, Perfect Day, is working on a solution. Per the company website: “Instead of having cows do all the work, we use microflora and age-old fermentation techniques to make the very same dairy protein that cows make.” Toward that end, the Berkeley company closed a $35 million Series B in February, with backing from ADM.

Fermentation

Perfect Day isn’t the only fermentation play raising major funding.

Corporate food-tech investors have long been interested in the processing technologies that turn an obscure microbe or under-appreciated crop into a high-demand ingredient. And lately, LeClerc said, they’ve been particularly keen on startups finding new ways to apply the age-old technology known as fermentation.

Most of us know fermentation as the process that turns a yucky mix of grain, yeast and water into the popular beverage known as beer. More broadly, however, fermentation is a metabolic process that produces chemical changes in organic substrates through the action of enzymes. That is, take a substance, add something it reacts with and voilà, you have a new substance.

Several of the most heavily funded, buzz-generating companies in the food space are applying fermentation, LeClerc said. Besides Perfect Day, examples he points to include the unicorn Ginkgo Bioworks, Geltor (another alt-protein startup) and mushroom-focused MycoTechnology.

Colorado-based MycoTechnology has been a particularly attractive investor target of late. The company has raised $83 million from a mix of corporate and traditional VCs, including a $30 million Series C in January that included Tyson and Kellogg’s venture arm, Eighteen94 Capital. Founded six years ago, the company is pursuing a range of applications for its fermented fungi, including flavor enhancers, protein supplements and preservatives.

Supply chain

Besides adding strange new ingredients to our grocery shelves, corporate food-tech investors are also putting money into technologies and platforms aimed at boosting the security and efficiency of existing supply chains.

Just like new foods, much of the food safety tech sounds odd, too. Silicon Valley-based ImpactVision, a seed-funded startup backed by Campbell Soup VC arm Acre Venture Partners, wants to employ hyper-spectral imaging to perceive information about contamination, food quality and ripeness.

Boston-based Spoiler Alert, another Acre portfolio company, develops software and analytics for food companies to manage unsold inventory. And Pensa Systems, which uses AI-powered autonomous drones to track in-store inventory, raised a Series A round this year with backing from the venture arm of Anheuser-Busch InBev.

Is weirder better?

We highlighted a few trends in corporate food-tech investment, but there are others that merit attention, as well. Probiotics plays, including the maker of the GoodBelly drink line, are generating investor interest. New ingredients other than proteins are also attracting capital, such as UCAN, a startup developing energy snacks based on a novel, slow-digesting carbohydrate. And the list goes on.

Much of the early enthusiasm for new products stems from disillusionment with the existing ingredients we overeat. But LeClerc noted that new products aren’t always better in the long run — they just might seem so at first.

“The question in the back of our head is: Are we ever creating margarine 2.0,” he said. “Just because it’s a plant product doesn’t mean it’s actually better for you.”

via Startups – TechCrunch https://tcrn.ch/2UNzlMc

Acquisitions, more than IPOs, will create Africa’s early startup successes

Africa has made its global IPO debut. Pan-African e-commerce company Jumia—a $1 billion-valued company—began trading live on the NYSE last week.

The stock offering made Jumia the first upstart operating in Africa to list on a major global exchange.

This raises expectations for unicorns and IPOs to create the continent’s first wave of startup moguls. But unlike other markets, big public listings and nine-figure valuations could remain rare in Africa.

The rise of venture arms and startup acquisitions will factor more prominently than IPOs in creating Africa’s early startup successes.

I’ll break down why. First, a quick briefer.

Primer on African tech

Not everyone may be aware, but yes, Africa has a booming tech scene. When measured by monetary values, it’s minuscule by Shenzen or Silicon Valley standards.

via Startups – TechCrunch https://tcrn.ch/2W1bDJ2

Startups Weekly: Zoom CEO says its stock price is ‘too high’

When Zoom hit the public markets Thursday, its IPO pop, a whopping 81 percent, floored everyone, including its own chief executive officer, Eric Yuan.

Yuan became a billionaire this week when his video conferencing business went public. He told Bloomberg that he actually wished his stock hadn’t soared quite so high. I’m guessing his modesty and laser focus attracted Wall Street to his stock; well, that, and the fact that his business is actually profitable. He is, this week proved, not your average tech CEO.

I chatted with him briefly on listing day. Here’s what he had to say.

“I think the future is so bright and the stock price will follow our execution. Our philosophy remains the same even now that we’ve become a public company. The philosophy, first of all, is you have to focus on execution, but how do you do that? For me as a CEO, my number one role is to make sure Zoom customers are happy. Our market is growing and if our customers are happy they are going to pay for our service. I don’t think anything will change after the IPO. We will probably have a much better brand because we are a public company now, it’s a new milestone.”

“The dream is coming true,” he added.

For the most part, it sounded like Yuan just wants to get back to work.

Want more TechCrunch newsletters? Sign up here. Otherwise, on to other news…

You thought I was done with IPO talk? No, definitely not:

- Pinterest completed its IPO this week too! Here’s the TLDR: Pinterest popped 25 percent on its debut Thursday and is currently trading up 28 percent. Not bad, Pinterest, not bad.

- Fastly, a startup I’d admittedly never heard of until this week, filed its S-1 and displayed a nice path to profitability. That means the parade of tech IPOs is far from over.

- Uber… Surprisingly, no Uber IPO news this week. Sit tight, more is surely coming.

While I’m on the subject of Uber, the company’s autonomous vehicles unit did, in fact, raise $1 billion, a piece of news that had been previously reported but was confirmed this week. With funding from Toyota, Denso and SoftBank’s Vision Fund, Uber will spin-out its self-driving car unit, called Uber’s Advanced Technologies Group. The deal values ATG at $7.25 billion.

The TechCrunch staff traveled to Berkeley this week for a day-long conference on robotics and artificial intelligence. The highlight? Boston Dynamics CEO Marc Raibert debuted the production version of their buzzworthy electric robot. As we noted last year, the company plans to produce around 100 models of the robot in 2019. Raibert said the company is aiming to start production in July or August. There are robots coming off the assembly line now, but they are betas being used for testing, and the company is still doing redesigns. Pricing details will be announced this summer.

#TCRobotics pic.twitter.com/Vf4kUWH0fR

— Lucas Matney (@lucasmtny) April 19, 2019

Digital health investment is down

Despite notable rounds for digital health businesses like Ro, known for its direct-to-consumer erectile dysfunction medications, investment in the digital health space is actually down, reports TechCrunch’s Jonathan Shieber. Venture investors, private equity and corporations funneled $2 billion into digital health startups in the first quarter of 2019, down 19 percent from the nearly $2.5 billion invested a year ago. There were also 38 fewer deals done in the first quarter this year than last year, when investors backed 187 early-stage digital health companies, according to data from Mercom Capital Group.

Byton loses co-founder and former CEO, reported $500M Series C to close this summer

Lyric raises $160M from VCs, Airbnb

Brex, the credit card for startups, raises $100M debt round

Ro, a D2C online pharmacy, reaches $500M valuation

Logistics startup Zencargo gets $20M to take on the business of freight forwarding

Co-Star raises $5M to bring its astrology app to Android

Y Combinator grad Fuzzbuzz lands $2.7M seed round to deliver fuzzing as a service

Hundreds of billions of dollars in venture capital went into tech startups last year, topping off huge growth this decade. VCs are reviewing more pitch decks than ever, as more people build companies and try to get a slice of the funding opportunities. So how do you do that in such a competitive landscape? Storytelling. Read contributor’s Russ Heddleston’s latest for Extra Crunch: Data tells us that investors love a good story.

Plus: The different playbook of D2C brands

And finally, for the first of a new series on VC-backed exits aptly called The Exit. TechCrunch’s Lucas Matney spoke to Bessemer Venture Partners’ Adam Fisher about Dynamic Yield’s $300M exit to McDonald’s.

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and I chat about rounds for Brex, Ro and Kindbody, plus special guest Danny Crichton joined us to discuss the latest in the chip and sensor world.

via Startups – TechCrunch https://tcrn.ch/2VX6P78

Fastly, the content delivery network, files for an IPO

Fastly, the content delivery network that’s raised $219 million in financing from investors (according to Crunchbase), is ready for its close up in the public markets.

The eight-year-old company is one of several businesses that improve the download time and delivery of different websites to internet browsers and it has just filed for an IPO.

Media companies like The New York Times use Fastly to cache their homepages, media and articles on Fastly’s servers so that when somebody wants to browse the Times online, Fastly’s servers can send it directly to the browser. In some cases, Fastly serves up to 90 percent of browser requests.

E-commerce companies like Stripe and Ticketmaster are also big users of the service. They appreciate Fastly because its network of servers enable faster load times — sometimes as quickly as 20 or 30 milliseconds, according to the company.

The company raised its last round of financing roughly nine months ago, a $40 million investment that Fastly said would be the last before a public offering.

True to its word, the company is hoping public markets have the appetite to feast on yet another “unicorn” business.

While Fastly lacks the sizzle of companies like Zoom, Pinterest or Lyft, its technology enables a huge portion of the activities in which consumers engage online, and it could be a bellwether for competitors like Cloudflare, which recently raised $150 million and was also exploring a public listing.

The company’s public filing has a placeholder amount of $100 million, but given the amount of funding the company has received, it’s far more likely to seek closer to $1 billion when it finally prices its shares.

Fastly reported revenue of roughly $145 million in 2018, compared to $105 million in 2017, and its losses declined year on year to $29 million, down from $31 million in the year-ago period. So its losses are shrinking, its revenue is growing (albeit slowly) and its cost of revenues are rising from $46 million to around $65 million over the same period.

That’s not a great number for the company, but it’s offset by the amount of money that the company’s getting from its customers. Fastly breaks out that number in its dollar-based net expansion rate figure, which grew 132 percent in 2018.

It’s an encouraging number, but as the company notes in its prospectus, it’s got an increasing number of challenges from new and legacy vendors in the content delivery network space.

The market for cloud computing platforms, particularly enterprise-grade products, “is highly fragmented, competitive and constantly evolving,” the company said in its prospectus. “With the introduction of new technologies and market entrants, we expect that the competitive environment in which we compete will remain intense going forward. Legacy CDNs, such as Akamai, Limelight, EdgeCast (part of Verizon Digital Media), Level3, and Imperva, and small business-focused CDNs, such as Cloudflare, InStart, StackPath, and Section.io, offer products that compete with ours. We also compete with cloud providers who are starting to offer compute functionality at the edge like Amazon’s CloudFront, AWS Lambda, and Google Cloud Platform.”

via Startups – TechCrunch https://tcrn.ch/2Gx4QRX

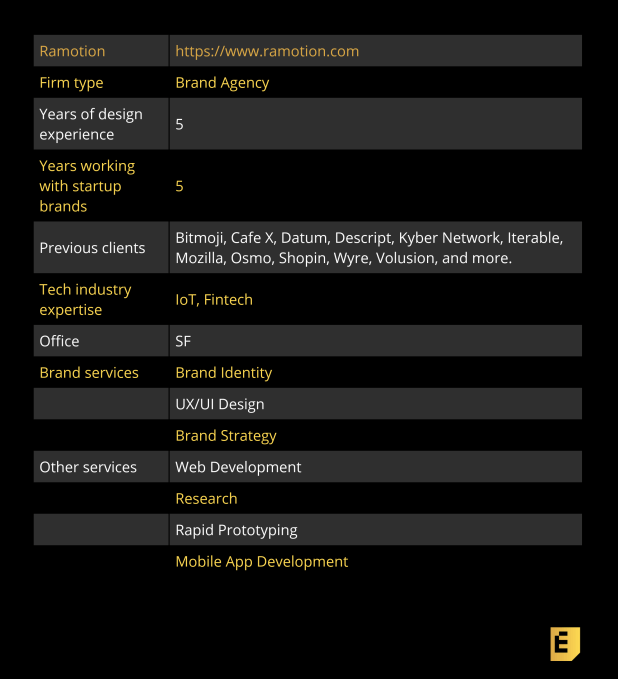

Verified Expert Brand Designer: Ramotion

Ramotion is a remote branding and product design agency that has worked with Bay Area tech startups since 2014. While they typically do branding for funded, fast-growing startups, Ramotion has helped companies ranging from Bitmoji’s early brand identity to Mozilla’s rebrand. We spoke to Ramotion’s CEO Denis Pakhaliuk about their iterative approach, his favorite branding projects and more.

Ramotion’s branding philosophy:

“We are a big fan of starting small: designing a small package, releasing it and then iterating on top of that. So, founders need to be focused on what’s really necessary right now for their next round of investment or product releases.”

On common founder mistakes:

“I think some founders think they need everything, but they actually need an MVP and product design. The same goes for brand identity. They need to have some key elements like colors, typeface and the logo. There is no need to do everything in the beginning, because the logo and brand identity becomes meaningful after it’s used. It’ll eventually improve.”

“They’re the reason we have such an amazing logo today.” Kevin Sproles, Austin, founder & CEO at Volusion

Below, you’ll find the rest of the founder reviews, the full interview and more details like pricing and fee structures. This profile is part of our ongoing series covering startup brand designers and agencies with whom founders love to work, based on this survey and our own research. The survey is open indefinitely, so please fill it out if you haven’t already.

Interview with Ramotion’s CEO Denis Pakhaliuk

Yvonne Leow: Can you tell me about your journey and how you came to create Ramotion?

Denis Pakhaliuk: Yeah, I started as a CG designer more than 10 years ago. I was doing computer graphics, CG modeling, digitalization of architectural design and automotive design. I was initially very focused on German cars and industrial design. Once iPhone 3G came out, I switched to doing UI design for mobile apps, which was a very hot topic at the time.

From that point I met a guy who just said, “Hey, I’m thinking of building an agency,” and so we decided to do it together. It started with a few people and now we have up to 30. We focus on different products, from small companies to more established brands, like Salesforce, among others. So yeah, it’s been a fun journey.

Yvonne Leow: At what point did Ramotion start working with startups?

via Startups – TechCrunch https://tcrn.ch/2IJGQfY

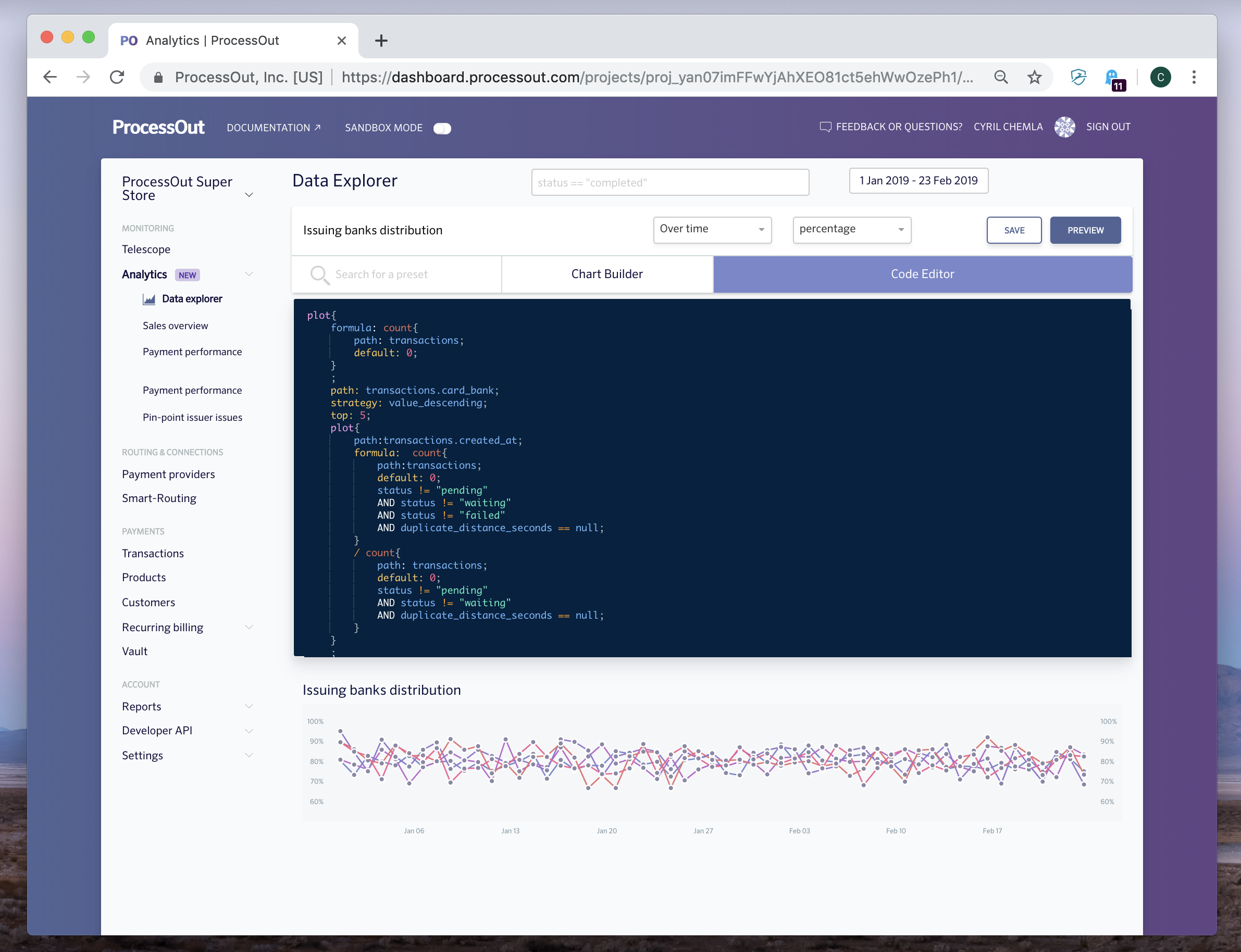

ProcessOut improves payment data visualization

ProcessOut has grown quite a lot since I first covered the startup. The company now has a ton of small and big clients, from Glovo to Vente-Privée and Dashlane. The company has become an expert on payment providers and payment analytics.

The core of the product remains the same. Clients sign up to get an overview on the performance of their payment systems. After setting up ProcessOut Telescope, you can monitor payments with expensive fees, failed payments and disappointing payment service providers.

And this product is quite successful. Back in October 2018, the company had monitored $7 billion in transactions since its inception — last month, that number grew to $13 billion.

The company is adding new features to make it easier to get insights from your payment data. You can now customize your data visualization dashboards with a custom scripting language called ProcessOut Lang. This way, if you have an internal payment team, they can spot issues more easily.

ProcessOut can also help you when it comes to generating reports. The company can match transactions on your bank account with transactions on different payment providers.

If you’re a smaller company and can’t optimize your payment module yourself, ProcessOut also builds a smart-routing checkout widget. When a customer pays something, the startup automatically matches card information with the best payment service provider for that transaction in particular.

Some providers are quite good at accepting all legit transactions, such as Stripe or Braintree. But they are also more expensive than more traditional payment service providers. ProcessOut can predict if a payment service provider is going to reject this customer before handing the transaction to that partner. It leads to lower fees and a lower rejection rate.

The company recently added support for more payment service providers in Latin America, such as Truevo, AllPago and Mercadopago. And ProcessOut now routes more transactions in one day compared to the entire month of October 2018.

As you can see, the startup is scaling nicely. It will be interesting to keep an eye on it.

via Startups – TechCrunch https://tcrn.ch/2UpeSZ2

Uber’s self-driving car unit raises $1B from Toyota, Denso and Vision Fund ahead of spin-out

Uber has confirmed it will spin out its self-driving car business after the unit closed $1 billion in funding from Toyota, auto-parts maker Denso and SoftBank’s Vision Fund.

The development has been speculated for some time — as far back as October — and it serves to both remove a deeply unprofitable unit from the main Uber business, helping Uber scale back some of its losses, while giving Uber’s Advanced Technologies Group (known as Uber ATG) more freedom to focus on the tough challenge of bringing autonomous vehicles to market.

The deal values Uber ATG at $7.25 billion, the companies announced. In terms of the exact mechanics of the investment, Toyota and Denso are providing $667 million, with the Vision Fund throwing in the remaining $333 million.

The deal is expected to close in Q3, and it gives investors a new take on Uber’s imminent IPO, which comes with Uber ATG. The company posted a $1.85 billion loss for 2018, but R&D efforts on “moonshots” like autonomous cars and flying vehicles dragged the numbers down by accounting for more than $450 million in spending. Moving those particularly capital-intensive R&D plays into a new entity will help bring the core Uber numbers down to earth, but clearly there’s still a lot of work to reach break-even or profitability.

Still, those crazy numbers haven’t dampened the mood. Uber is still seen as a once-in-a-generation company, and it is tipped to raise around $10 billion from the IPO, giving it a reported valuation of $90 billion-$100 billion.

Like the spin-out itself, the identity of the investors is not a surprise.

The Vision Fund (and parent SoftBank) have backed Uber since a January 2018 investment deal closed, while Toyota put $500 million into the ride-hailing firm last August. Toyota and Uber are working to bring autonomous Sienna vehicles to Uber’s service by 2021 while, in further proof of their collaborative relationship, SoftBank and Toyota are jointly developing services in their native Japan, which will be powered by self-driving vehicles.

The duo also backed Grab — the Southeast Asian ride-hailing company in which Uber owns around 23 percent — perhaps more aggressively. SoftBank has been an investor since 2014, and last year Toyota invested $1 billion into Grab, which it said was the highest investment it has made in ride hailing.

“Leveraging the strengths of Uber ATG’s autonomous vehicle technology and service network and the Toyota Group’s vehicle control system technology, mass-production capability, and advanced safety support systems, such as Toyota Guardian, will enable us to commercialize safer, lower cost automated ridesharing vehicles and services,” said Shigeki Tomoyama, the executive VP who leads Toyota’s “connected company” division, said in a statement.

Here’s Uber CEO Dara Khosrowshahi’s shorter take on Twitter:

Excited to announce Toyota, Denso and the SoftBank Vision Fund are making a $1B investment in @UberATG, as we work together towards the future of mobility. pic.twitter.com/JdqhLkV7uU

— dara khosrowshahi (@dkhos) April 19, 2019

via Startups – TechCrunch https://tcrn.ch/2KY9kFA

Index Ventures, Stripe back bookkeeping service Pilot with $40M

Five years after Dropbox acquired their startup Zulip, Waseem Daher, Jeff Arnold and Jessica McKellar have gained traction for their third business together: Pilot.

Pilot helps startups and small businesses manage their back office. Chief executive officer Daher admits it may seem a little boring, but the market opportunity is undeniably huge. To tackle the market, Pilot is today announcing a $40 million Series B led by Index Ventures with participation from Stripe, the online payment processing system.

The round values Pilot, which has raised about $60 million to date, at $355 million.

“It’s a massive industry that has sucked in the past,” Daher told TechCrunch. “People want a really high-quality solution to the bookkeeping problem. The market really wants this to exist and we’ve assembled a world-class team that’s capable of knocking this out of the park.”

San Francisco-based Pilot launched in 2017, more than a decade after the three founders met in MIT’s student computing group. It’s not surprising they’ve garnered attention from venture capitalists, given that their first two companies resulted in notable acquisitions.

Pilot has taken on a massively overlooked but strategic segment — bookkeeping,” Index’s Mark Goldberg told TechCrunch via email. “While dry on the surface, the opportunity is enormous given that an estimated $60 billion is spent on bookkeeping and accounting in the U.S. alone. It’s a service industry that can finally be automated with technology and this is the perfect team to take this on — third-time founders with a perfect combo of financial acumen and engineering.”

The trio of founders’ first project, Linux upgrade software called Ksplice, sold to Oracle in 2011. Their next business, Zulip, exited to Dropbox before it even had the chance to publicly launch.

It was actually upon building Ksplice that Daher and team realized their dire need for tech-enabled bookkeeping solutions.

“We built something internally like this as a byproduct of just running [Ksplice],” Daher explained. “When Oracle was acquiring our company, we met with their finance people and we described this system to them and they were blown away.”

It took a few years for the team to refocus their efforts on streamlining back-office processes for startups, opting to build business chat software in Zulip first.

Pilot’s software integrates with other financial services products to bring the bookkeeping process into the 21st century. Its platform, for example, works seamlessly on top of QuickBooks so customers aren’t wasting precious time updating and managing the accounting application.

“It’s better than the slow, painful process of doing it yourself and it’s better than hiring a third-party bookkeeper,” Daher said. “If you care at all about having the work be high-quality, you have to have software do it. People aren’t good at these mechanical, repetitive, formula-driven tasks.”

Currently, Pilot handles bookkeeping for more than $100 million per month in financial transactions but hopes to use the infusion of venture funding to accelerate customer adoption. The company also plans to launch a tax prep offering that they say will make the tax prep experience “easy and seamless.”

“It’s our first foray into Pilot’s larger mission, which is taking care of running your companies entire back office so you can focus on your business,” Daher said.

As for whether the team will sell to another big acquirer, it’s unlikely.

“The opportunity for Pilot is so large and so substantive, I think it would be a mistake for this to be anything other than a large and enduring public company,” Daher said. “This is the company that we’re going to do this with.”

via Startups – TechCrunch https://tcrn.ch/2VSKCHz

Uber, Lyft implement new safety measures

Uber and Lyft instituted new safety features and policies this week.

The move follows the death of Samantha Josephson, a student at the University of South Carolina, who was kidnapped and murdered in late March. She was found dead after getting into a vehicle that she believed to be her Uber ride. The murder, which has garnered nationwide media attention, seems to have spurred action by the ridesharing behemoths.

In response, Uber is launching the Campus Safety Initiative, which includes new features in the app. Currently, the features are in testing, and they remind riders to check the license plate, make and model of the car, as well as the driver’s name and picture, before ever entering into a vehicle. The test is running in South Carolina, in partnership with the University of South Carolina, with plans to roll out nationwide.

Lyft, which went public on March 29, has implemented continuous background checks for drivers this week. (Uber has had this in place since last year.) Lyft also enhanced its identity verification process for drivers, which combines driver’s license verification and photographic identity verification to prevent driver identity fraud on the platform.

Uber, prepping to debut on the public market, is taking the safety precautions seriously. The new system reminds riders about checking their ride three separate times: the first is a banner at the bottom of the app once the ride has been ordered, the second is a warning to check license plate, car details and photo, and the third is an actual push notification before the driver arrives reminding riders to check once more.

Alongside the reminder system, Uber is also working to build out dedicated pickup zones in the Five Points district of Columbia, with plans to roll out dedicated pickup zones at other U.S. universities.

That said, Uber has also warned investors ahead of its IPO about a forthcoming safety report on the company, which could be damaging to the brand. The report is supposed to be released sometime this year, and will give the public its first comprehensive look at the scale of safety incidents and issues that occur on the platform.

“The public responses to this transparency report or similar public reporting of safety incidents claimed to have occurred on our platform … may result in negative media coverage and increased regulatory scrutiny and could adversely affect our reputation with platform users,” said Uber in its April 14 IPO paperwork.

Indeed, the issue of safety on platforms like Uber and Lyft, or really any app that asks you to be alone with total strangers, goes well beyond any single incident. A CNN investigation found that 103 Uber drivers had been accused of sexual assault or abuse in the last four years.

via Startups – TechCrunch https://tcrn.ch/2Pg1xBr

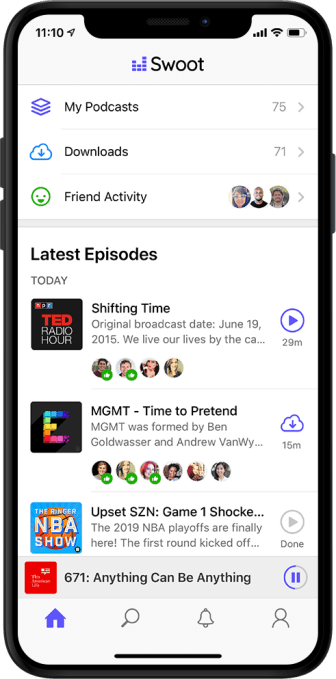

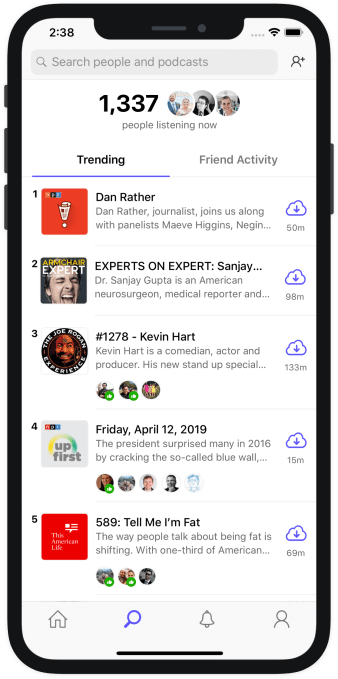

HipChat founders launch Swoot, a social podcast app

Pete Curley and Garret Heaton, who previously co-founded team chat app HipChat and sold it to Atlassian, are officially launching their new product, Swoot, today. The app makes it easy for users to recommend podcasts and see what their friends are listening to.

This might seem like a big leap from selling enterprise software — and indeed, Curley said the company was initially focused on creating another set of team collaboration tools.

What they realized, however, was that HipChat is “actually a consumer product that the company just happens to pay for, because the employees demand it” — and he said they weren’t terribly interested in trying to build a business around a more traditional “top-down sales process.”

Meanwhile, Curley said he’d injured his back while lowering one of his children into a crib, which meant that for months, his only form of exercise was walking. He recalled walking around for hours each day and, for the first time, keeping himself entertained by listening to podcasts.

“I was actually way behind the times,” he said. “I didn’t know this, that everyone else was listening to them … This is like the dark web of content.”

The startup has already raised a $3 million seed funding round led by True Ventures.

“Pete and Garret both have incredible product and entrepreneurial experience, plus they have built successful businesses together in the past,” said True Ventures co-founder Jon Callaghan in a statement. “Their focus of solving the disjointed podcast listening experience through Swoot’s elegant design fills a clear gap in media discovery.”

Discovery — namely, finding new podcasts beyond the handful that you already subscribe to — is one of the biggest issues in podcasting right now. It’s something a number of companies are trying to solve, but in Curley’s view, the key is to make the listening experience more social.

He noted that social sharing features are getting added to “literally everything,” including your bathroom scale, except “the one thing that I actually wanted it for.”

Curley also contrasted the podcast listening experience with YouTube: “We don’t realize how big [podcasting] is because there is no social thing where you see that Gangnam Style has 8 billion views, and you realize that the entire world is watching. There’s no view count, no anything that tells you what’s popular.”

So he’s trying to provide that view with Swoot. Instead of focusing on overall listen counts (which might not be that impressive in a new app), Swoot gives you two main ways to track what’s popular among your friends.

There’s a feed that shows you everything that your friends are listening to or recommending, plus a list of episodes that are currently trending, with little icons showing you the friends who have listened to at least 20 percent of an episode.

Curley said the team has been beta testing the app by simply releasing it on the App Store and telling friends about it, then letting it spread by word of mouth until it was in the hands of around 1,000 users. During that test, it found that 25 percent of the podcasts that users listened to were coming from friends.

Curley also noted that this approach is “episode-centric” rather than “show-centric.” In other words, it’s not just helping you find the next podcast that you want to subscribe to and listen to for years — it also helps surface the specific episode that everyone’s listening to right now.

“In the 700,000 shows that exist, if you’re the 690,000 worst-ranked show, but you have one great episode that should be able to go viral, that’s basically impossible to do right now, because audio is crazy hard to share,” Curley said.

In the course of our conversation, I brought up my experience with Spotify — I like knowing what’s popular, but when a friend recently mentioned specific songs that they could see I’d been listening to on the service, I was a bit creeped out.

“It’s funny, I actually thought, how ironic that Spotify is getting into podcasting now [through the acquisitions of Gimlet and Anchor],” Curley replied. “They actually had this correct mechanism applied to the wrong thing. Music is a deeply personal thing.”

Which isn’t to say that podcast listening isn’t personal, but there’s more of an opportunity to discover overlapping interests, say the fact that you and your friends all listen to true crime podcasts.

Curley also said that the app is deliberately designed to ensure that “the service does not get worse because a ton of people follow you” — so they see what you are listening to, but they can’t comment on it or tell you that you’re an idiot for listening.

At the same time, he also said the team will be adding a mode to only share podcasts you actively recommend, rather than posting everything you listen to.

As for making money, Curley suggested that he’s interested in exploring a variety of possibilities, whether that’s integrating with other subscription or tipping services, or in creating ad opportunities around promoting podcasts.

“My actual answer is, there are a bunch of people trying to monetize right now, but I don’t think there’s a platform even close to mature enough to even try to monetize podcasting yet, other than podcasters doing their own advertising,” he said. “I think the endgame, where the real money is made in podcasting, actually hasn’t been come up with yet.”

via Startups – TechCrunch https://tcrn.ch/2UJcHEx

Y Combinator grad Fuzzbuzz lands $2.7M seed round to deliver fuzzing as service

Fuzzbuzz, a graduate of the most recent Y Combinator class, got the kind of news every early-stage startup wants to hear when it landed a $2.7 million seed round to help deliver a special class of automated software testing known as fuzzing in the form of a cloud service.

Fuel Capital led the round. Homebrew and Susa Ventures also participated, along with various angel investors, including Docker co-founder Solomon Hykes, Mesosphere co-founder Florian Leibert and Looker co-founder Ben Porterfield.

What Fuzzbuzz does specifically is automate fuzzing at scale, says co-founder and CEO Andrei Serban. “It’s a type of automated software testing that can perform thousands of tests per second,” he explained. Fuzzbuzz is also taking advantage of artificial intelligence and machine learning underpinnings to use feedback from the results to generate new tests automatically, so that it should get smarter as it goes along.

The goal is to cover as much of the code as possible, much faster and more efficiently than human testers ever could, and find vulnerabilities and bugs. It’s the kind of testing every company generating code would obviously want to do, but the problem is that up until now the process has been expensive and required highly specialized security engineers to undertake. Companies like Google and Facebook are able to hire these kinds of people to build fuzzing solutions, but for the most part, it’s been out of reach for your average company.

Serban says his co-founder, Everest Munro-Zeisberger, worked on the Google Chrome fuzzing team, which has surfaced more than 15,000 bugs using this technique. He wanted to put this type of testing in reach of anyone.

“Today, anyone can start fuzzing on Fuzzbuzz in less than 20 minutes. We hook directly into GitHub and your CI/CD pipeline, categorize and de-duplicate each bug found, and then notify you through tools like Slack and Jira. Using the Fuzzbuzz CLI, developers can then test and fix the bug locally before pushing their code back up to GitHub,” the company wrote in a blog post announcing the funding.

It’s still early days, and the startup is working with some initial customers. The funding should help the three founders, Serban, Munro-Zeisberger and Sabera Hussain, to hire more engineers and bring a more complete solution to market. It’s an ambitious undertaking, but if it succeeds in creating a fuzzing service, it could mean delivering code with fewer bugs, and that would be good for everyone.

via Startups – TechCrunch https://tcrn.ch/2VauF2e

VCs bet on cannabis vaping, ED meds and mobile fertility clinics

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week was a bit of a reunion with Kate and Alex on as usual, with the addition of Extra Crunch denizen extraordinaire Danny Crichton. Danny, you may recall, has been a semi-regular Equity co-host over the past year.

As Kate explains up front, Equity is out a day early this week due to the Big TechCrunch Robotics Affair in Berkeley today. We’ll be back on Friday with IPO news regarding Zoom and Pinterest, and we can’t wait.

OK, all that sorted, what did we talk about? Alex wanted to talk about some market signals that he reads as bullish. Whatever went wrong at the end of 2018 has healed over, he thinks, because there have been a whole lot of supergiant venture capital rounds and some other stuff.

Next, we gave an example of one of those supergiant rounds in the works. The reported Pax round, which could put $400 million into the cannabis vaping company, intrigues us, especially because Pax is the corporate sibling of JUUL, the now-famous e-cigarette company what sold just over a third of itself for nearly $13 billion last year. A truly staggering deal.

Then we turned to Brex, the fintech startup that was back in the news this week. Why? Because it raised a $100 million debt round as startups of that sort do. Brex provides a credit card made specifically for startups that require no personal-guarantee. Yeah, risky, we know. We talked about that risk and Brex’s plan to target Fortune 500 business in the future.

Rounds for Ro, Kindbody and Carrot Fertility made it a busy week for healthtech, too. Ro is raising at a $500 million valuation to support its three digital health brands: Roman, Rory and Zero. Meanwhile, a pair of fertility startups, Kindbody and Carrot, brought in $15 million and $11 million, respectively.

With Danny back on the show, we extended our reach and discussed the latest in the chip and sensor world. NXP, fresh off a failed, multi-billion-dollar exit to Qualcomm, put money into Hawkeye Technology, a China-based company working in the car sensor space. Equity’s regular hosts mostly nodded as Danny dropped a lot of knowledge.

All that and we had some fun. We’ll be back before you know it.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

via Startups – TechCrunch https://tcrn.ch/2vbNFyI

Astroscreen raises $1M to detect social media manipulation with machine learning

In an era of social media manipulation and disinformation, we could sure use some help from innovative entrepreneurs. Social networks are now critical to how the public consumes and shares the news. But these networks were never built for an informed debate about the news. They were built to reward virality. That means they are open to manipulation for commercial and political gain.

Fake social media accounts — bots (automated) and “sock-puppets” (human-run) — can be used in a highly organized way to spread and amplify minor controversies or fabricated and misleading content, eventually influencing other influencers and even news organizations. And brands are hugely open to this threat. The use of such disinformation to discredit brands has the potential for very costly and damaging disruption when up to 60 percent of a company’s market value can lie in its brand.

Astroscreen is a startup that uses machine learning and disinformation analysts to detect social media manipulation. It has now secured $1 million in initial funding to progress its technology. And it has a heritage that suggests it at least has a shot at achieving this.

Its techniques include coordinated activity detection, linguistic fingerprinting and fake account and botnet detection.

The funding round was led by Speedinvest, Luminous Ventures, UCL Technology Fund (which is managed by AlbionVC in collaboration with UCLB), AISeed and the London Co-investment Fund.

Astroscreen CEO Ali Tehrani previously founded a machine-learning news analytics company, which he sold in 2015 before fake news gained widespread attention. He said: “While I was building my previous startup I saw first-hand how biased, polarising news articles were shared and artificially amplified by vast numbers of fake accounts. This gave the stories high levels of exposure and authenticity they wouldn’t have had on their own.”

Astroscreen’s CTO Juan Echeverria, whose PhD at UCL was on fake account detection on social networks, made headlines in January 2017 with the discovery of a massive botnet managing some 350,000 separate accounts on Twitter.

Ali Tehrani also thinks social networks are effectively holed below the waterline on this whole issue: “Social media platforms themselves cannot solve this problem because they’re looking for scalable solutions to maintain their software margins. If they devoted sufficient resources, their profits would look more like a newspaper publisher than a tech company. So, they’re focused on detecting collective anomalies — accounts and behavior that deviate from the norm for their user base as a whole. But this is only good at detecting spam accounts and highly automated behavior, not the sophisticated techniques of disinformation campaigns.”

Astroscreen takes a different approach, combining machine-learning and human intelligence to detect contextual (instead of collective) anomalies — behavior that deviates from the norm for a specific topic. It monitors social networks for signs of disinformation attacks, informing brands if they’re under attack at the earliest stages and giving them enough time to mitigate the negative effects.

Lomax Ward, partner, Luminous Ventures, said: “The abuse of social media is a significant societal issue and Astroscreen’s defence mechanisms are a key part of the solution.”

via Startups – TechCrunch https://tcrn.ch/2IIaIcr

Marketing platform startup Adverity raises $12.4M in round led by Felix Capital

Marketers get a lot of incoming information from the data they have to deal with, bound up in hundreds of spreadsheets and reports, making it time-consuming and tricky to get value out of it. Tech companies like Datorama and Funnel.io have appeared to try to lighten this load.

Adverity is a data intelligence platform also playing in this space by applying AI to produce actionable insights in real time.

Founded in 2015, it’s a cloud-agnostic SaaS platform compatible with Amazon, Google and Microsoft that provides data to destinations such as SQL databases, Snowflake, AWS Redshift, SAP HANA. Its business model is based on yearly subscription fees.

It has now closed an €11 million ($12.4 million) Series B funding round, bringing the total amount raised to date to €15 million ($17 million). The investment is led by London-based Felix Capital, with participation from Silicon Valley’s Sapphire Ventures and the SAP.iO fund. The company now plans to use its war chest to expand into the U.S. market.

In addition to the latest round of investors, Adverity continues to be backed by existing investors, including Speedinvest, Mangrove Capital (early backer of Skype, Wix.com and Walkman), 42cap and local Austrian company the AWS Founders Fund.

Adverity’s latest AI-powered product, Presense, is currently under closed beta testing for select clients and will be launched later this year.

Alexander Igelsböck, CEO and co-founder of Adverity, commented: “Every company wants and needs to be data-driven. This is especially true in marketing where the fragmentation of data, and complexity in getting insights from it, poses a huge challenge for CMOs. Adverity’s mission is to solve those challenges by eliminating the hurdles facing companies today.”

Adverity’s clients include companies such as IKEA, Red Bull, Mediacom, Mindshare and IPG. Headquartered in Vienna, Austria, the company has offices across London, Sofia and Frankfurt.

Sasha Astafyeva, principal at Felix Capital, commented: “Data is a powerful tool for engaging customers and Adverity helps marketers harness the power of their data to make better decisions, grow their business and better serve their customers.”

The company’s founding members are Alexander Igelsböck, Martin Brunthaler and Andreas Glänzer. Igelsböck previously headed a startup incubator in Austria (KochAbo GmbH), and prior to that was VP Product Management at VeriSign Inc., where he met Brunthaler, who was director of Engineering. Glänzer’s experience was gained in a sales role at Google and as regional head of iProspect. The three previously founded a price comparison technology company that was acquired by Heise Media in Germany.

via Startups – TechCrunch https://tcrn.ch/2VaCRzE

Weengs, the UK logistics startup for online retailers, collects £6.5M Series A

Weengs, the U.K. logistics startup for e-commerce businesses that need a more convenient way of getting online orders to customers, has raised £6.5 million in Series A funding. Leading the round is venture capital firm Oxford Capital, with Weeng’s seed investors, including Local Globe, Cherry Ventures and VentureFriends, following on.

Founded by Alex Christodoulou and Greg Zontanos, Weengs provides small and medium-sized online stores of various kinds, including eBay and Amazon power sellers and brick ‘n’ mortar stores with an e-commerce component, with a “ship-from-store” logistics solution that handles collection, packing and delivery.

The basic premise is that time costs money, which can make e-commerce quite prohibitive. By outsourcing time-consuming and labour-intensive logistics, store owners can put their time into other more profitable and differentiating aspects of their business, such as sales and marketing, and customer experience.

To make this work, Weengs collects orders daily from retailers’ stores, and professionally packs them back at the Weengs warehouse before they are shipped to customers via the couriers with which the company partners.

Weengs says it can pack and ship globally a broad range of products, including less-obvious items such as plants, musical instruments and electronics and everyday items like cosmetics. It has developed algorithms to pick the most appropriate courier service based on the item and customer priorities.

“Our business is part of the rising omnichannel opportunity we are seeing in retail,” says Pier Ronzi, Weengs’ more recently added co-founder and CEO. “Increasingly, it makes sense for retailers to ship-from-store. Basically cities and stores are becoming distributed inventories that retailers can leverage to increase their business and Weengs helps them [by] offering a one-stop-shop solution for their fulfillment while they can focus on their core activity.”

Since Weengs’ seed round, the team has grown to 70 people and saw Ronzi, who previously worked at McKinsey & Co., join the company. The startup now has around 400 retailers as customers and says it has fulfilled more than 500,000 online orders to date.

“We have learnt that our service saves retailers a huge amount of time and that is the key to our value proposition versus, for example, price,” says Ronzi. Prior to Weengs, customers typically handled fulfillment themselves or used costly fulfillment centres.

To that end, Weengs says it will use the new funding to invest heavily in its new warehouse and accompanying automation and technology. The plan is to “supercharge” operations to be able to fulfill more than 15,000 e-commerce orders per day.

Explains the Weengs CEO: “The packing operations today is mainly manual. In the new automated warehouse we are implementing a process governed by our software and leveraging a packing machine that automatically performs the packing operations: the order item is fed to the machine and, at the end of a quick automated process, the order comes out packed in a very high standard and bespoke box, labelled and ready to be handed over to the carriers. The process becomes heavily automated but we still add the human touch for value-added activities such as preparation of fragile items and supervision of the whole process.”

via Startups – TechCrunch https://tcrn.ch/2KLH6gS

New Campaign Would Allow Cryptocurrency Donations To Be Distributed To Venezuelans

A new humanitarian aid campaign is trying to enable Venezuelans to use cryptocurrency instead of cash. NPR's Lulu Garcia-Navarro speaks with professor Steve Hanke, who is leading the campaign.

from Technology : NPR https://n.pr/2VldFpY

via IFTTT

Notre-Dame fire: How gamers are getting 'inside' the cathedral

from BBC News - Technology https://bbc.in/2vgwNGY

via IFTTT

Robot dogs pull truck and other tech news

from BBC News - Technology https://bbc.in/2ItXrFi

via IFTTT

Hands-on with the Samsung Galaxy Fold

from BBC News - Technology https://bbc.in/2v6CKq1

via IFTTT

Axiom soccer indie game takes a shot at goal

from BBC News - Technology https://bbc.in/2KMXDBt

via IFTTT

The robot that tidies up bedrooms

from BBC News - Technology https://bbc.in/2IqjJra

via IFTTT

Fitbit Inspire HR review: Detailed fitness tracking for a low price

Save $50 on a Google Home Hub smart display in the PCMag Shop

Get this PDF editor (a Mac App Store favorite) on sale for 30% off

These wireless fitness earbuds are over $100 cheaper than Powerbeats

‘Malicious software attack’ knocked the Weather Channel off-air for more than an hour

Zuckerberg could be held personally accountable for Facebook data breaches

Behold, the very bizarre Facebook auto-captions from NASA launch

YouTube gives Premium subscribers free Super Chat credits

Netflix is testing a shuffle option

Google bans embedded in-app sign-ins to curb phishing attacks

Battery Pack Deals: Save Up to 75% Off on Portable Chargers

Having a portable charger these days is a must. Between smartphones, tablets, and watches, it’s impossible to get through the day without desperately hunting for a power outlet. Fortunately, there are some great […]

The post Battery Pack Deals: Save Up to 75% Off on Portable Chargers appeared first on Geek.com.

from Geek.com http://bit.ly/2KPhDTQ

via IFTTT

Google’s Earth Day Doodle Celebrates the Beauty of Our Planet

Our planet is home to many interesting creatures, and to celebrate Earth Day 2019, Google created the ultimate Doodle that admires Mother Nature’s beauty. When you click on the Earth Day 2019 Google […]

The post Google’s Earth Day Doodle Celebrates the Beauty of Our Planet appeared first on Geek.com.

from Geek.com http://bit.ly/2IwrHz9

via IFTTT

Geek Pick: Garmin Vivoactive 3 Music Elevates Your Workout Playlists

Having the right playlist or podcast can make a difference for your workouts. And, if you’re looking for a wearable that offers high-tech tracking and audio perks, the Garmin Vivoactive 3 Music is […]

The post Geek Pick: Garmin Vivoactive 3 Music Elevates Your Workout Playlists appeared first on Geek.com.

from Geek.com http://bit.ly/2W2Xzic

via IFTTT

Gray Whales Killed By Ship Strikes in San Francisco Bay Area

Two gray whales that stranded in beaches in the San Francisco Bay Area died from blunt force trauma that can be attributed to ship strikes, scientists said Friday. Researchers from The Marine Mammal […]

The post Gray Whales Killed By Ship Strikes in San Francisco Bay Area appeared first on Geek.com.

from Geek.com http://bit.ly/2vfPj2s

via IFTTT

Sonar ‘Accidentally’ Detects 16th-Century Dutch Shipwreck

In what is being hailed as a lucky accident, a salvage team looking for containers that had fallen off a transport ship in Dutch waters discovered a 16th-century shipwreck on the North Sea floor. […]

The post Sonar ‘Accidentally’ Detects 16th-Century Dutch Shipwreck appeared first on Geek.com.

from Geek.com http://bit.ly/2VWUcsY

via IFTTT

Waterborne DNA provides a picture of coral reef health

In these times of coral reef die-offs, it's vitally important to monitor the abundance and variety of corals on the reefs that remain. This is currently performed visually by scuba divers, but there may soon be a quicker, cheaper and easier method – just check the water for coral DNA.

.. Continue Reading Waterborne DNA provides a picture of coral reef healthCategory: Biology

Tags:

from New Atlas (Gizmag) http://bit.ly/2GnNPbC

via IFTTT

Synthetic molecule shows promise as multiple sclerosis treatment

In multiple sclerosis, the body's immune system attacks and damages myelin, which is the insulating layer on nerves in the spinal cord, brain and optic nerve. This causes the nerves to short-circuit and cease functioning properly. In "a potential game-changer," scientists have now demonstrated that a synthetic molecule can restore compromised myelin.

.. Continue Reading Synthetic molecule shows promise as multiple sclerosis treatmentCategory: Medical

Tags:

from New Atlas (Gizmag) http://bit.ly/2KO7ebe

via IFTTT

Kia's HabaNiro concept opens the doors to high-tech "everything cars" of the future

Kia adds a little color and spice to its crossover stable with the new HabaNiro concept. Using "more advanced tech than what helped land men on the moon," the HabaNiro bridges the gap between city commuter and open-road explorer, becoming an "all-electric everything car." The 171-in (443-cm) crossover combines a 300-mile (483-km) electric powertrain with next-gen technologies like Level 5 autonomy, a reactive emotion-reading system, and a windshield-stretching, eye-tracking head-up display.

.. Continue Reading Kia's HabaNiro concept opens the doors to high-tech "everything cars" of the futureCategory: Automotive

Tags:

- Autonomous Vehicles

- Concept Cars

- Crossover

- Electric Vehicles

- Kia

- New York Auto Show 2019

- Self driving cars

from New Atlas (Gizmag) http://bit.ly/2V3BItH

via IFTTT