Total Pageviews

Wednesday, 25 September 2019

Volvo is turning its tough little robot into its first electric car

from Digital Trends https://ift.tt/2loXHLQ

via IFTTT

The Porsche Taycan is the first EV tuner Hennessey is putting its hands into

from Digital Trends https://ift.tt/2n5EOhl

via IFTTT

Manila-based payments processing startup PayMongo raises $2.7 million in seed funding

Manila-based financial tech startup PayMongo has raised $2.7 million in seed funding to give merchants in the Philippines and other Southeast Asian markets simple ways to set up online payments. Investors included Founders Fund, Peter Thiel and Stripe, with participation from Y Combinator (PayMongo is the first Philippine fintech company it has funded), Global Founders Capital, Soma Capital, Tinder co-founder Justin Mateen and other angel investors.

PayMongo was launched in June by a founding team that includes CEO Francis Plaza, COO Edwin Lacierda, CTO Jamie Hing and chief growth officer Luis Sia. Since then, more than 1,000 businesses have started using its platform and the startup says its total transaction value processed is growing at an average of 117% week over week. PayMongo’s seed round will be used for hiring, product development, business acquisitions and strategic partnerships.

The startup will focus on the Philippines first, where the country’s central bank has set a target of increasing the rate of cashless payments to 20%. Plaza says PayMongo’s goal is to become the largest payment service provider in the country before expanding to other markets in Southeast Asia.

Prior to launching PayMongo, its team spent several years working on other projects. During that time, they realized payments were the hardest feature to integrate into products and services. Even though the Philippines’ Internet economy is growing quickly (a report from Google expects it to increase from $5 billion in 2018 to $21 billion by 2025) and more people are using e-commerce, online payments have lagged behind the rest of the world, Plaza says.

“When you want to launch something online for a payment gateway, you have to deal with banks and many different financial institutions. It takes months, we tried it ourselves, from negotiating rates to submitting paperwork. It takes a long time, and then in the end you are charged high fees,” he tells TechCrunch.

Even after businesses finish dealing with banks, they need to figure out payment gateways that are often difficult for people with little tech experience to start using.

PayMongo has already partnered with several financial institutions and its technology, including a payments API that Plaza says can be set up in minutes, is designed to be user friendly. Since many online merchants in the Philippines sell through social media platforms and messaging apps, like Facebook, Instagram, Viber and WhatsApp, PayMongo also provides customizable payment links that they can send to customers.

The credit card penetration rate in the Philippines is only about 6%, Plaza says, so PayMongo also supports e-wallets like GCash and PayMaya and services that allow people to pay for online purchases in cash at convenience stores. PayMongo’s products for micro-entrepreneurs, like freelancers and people who sell items through social media, help it differentiate from competitors like Paynamics, Dragonpay and PesoPay that typically focus on serving larger businesses (though Plaza says PayMongo has also been adopted by large retail chains).

In a statement, Y Combinator partner Kevin Hale said “At YC, we love companies who build services that empower startups. We believe PayMongo will provide the infrastructure that is needed for more Filipinos to become founders who are in charge of their own destiny.”

via Startups – TechCrunch https://ift.tt/2l1WY2X

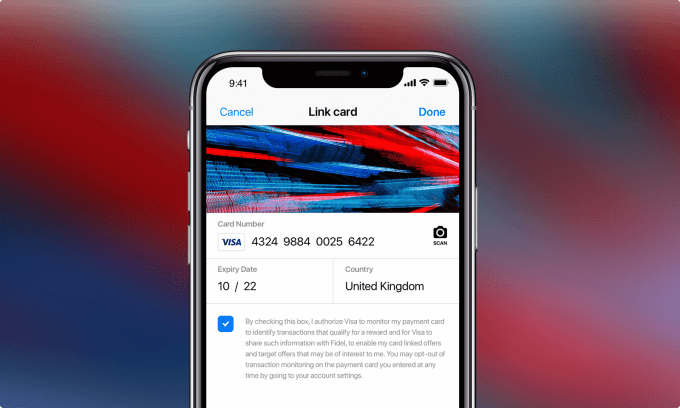

Fidel raises $18M to let developers build on top of payment data from Visa, MasterCard and Amex

Fidel, the U.K.-headquartered startup that offers an API to let developers build functionality, such as rewards, on top of the major card payment networks, has raised $18 million in Series A funding.

The pretty sizeable round is co-led by U.S.-based fintech funds Nyca Partners and QED Investors. Also participating are Citi Ventures, Commerce VC, Elefund, Horizons Ventures, RBC Ventures Inc. (a subsidiary of Royal Bank of Canada), and 500 Startups. Several angel investors also joined in, such as Cris Conde, former CEO of Sungard, and Taavet Hinrikus, founder of TransferWise.

Meanwhile, Hans Morris, former President of Visa and Managing Partner of Nyca Partners, and Yusuf Ozdalga, Partner at QED Investors, will join the company’s board.

Fidel says the new funding will be used to expand the Fidel team and support the company’s growth, product development and international ambitions in North America, the Nordics and APAC.

Working in partnership with Mastercard, Visa and American Express, put simply Fidel has developed a suite of APIs that make it easy to link a user’s payment card to an app. This means that developers are able to build card-linked applications “in a matter of minutes,” such as loyalty-based rewards and more innovative use-cases afforded by access to the real-time data that card payment networks can provide.

Not only does Fidel offer a single point of integration — thanks to its partnerships with all three card networks — but the company also removes the burden of regulatory compliance from its customers by securely tokenising card numbers. “All of this helps businesses get to market and scale faster,” says Fidel co-founder and CEO Subrata Dev.

“Card-linking is the optimal choice for any user journey that relies upon real-time payment information, location accuracy and a frictionless customer experience,” he says. This includes loyalty, digital receipts, PFM/expense management, and “online-to-offline attribution”.

Loyalty is currently Fidel’s main use case. This typically sees a user sign up to a loyalty program, where they can earn points, rewards and cash back automatically when they pay using a registered card. It’s the card-linking aspect that Fidel makes possible, regardless of what type of card it is and who the user banks with. Of course, with any such loyalty app, cards are only linked when a user opts in.

One example of Fidel-powered card-linking is the British Airways Executive Club app that lets members earn Avios points automatically when they shop with any linked credit or debit card at participating retailers.

Dev tells me the benefits of using Fidel instead of “open data sources” enabled through Open Bankking/PSD2 is that card network data is real-time and granular. In contrast, bank account data, especially that offered by legacy banks as apposed to challengers, can be slow and quite limited.

“We are able to see specific information including – crucially – location, in real-time, which is pivotal to many use cases,” he explains. “Open data sources typically provide much lower quality data, even once scraped. Card-linking is also frictionless for the user, who registers their card once and shops as usual. Again, this is key for loyalty and retention use cases where open banking’s requirement for customers to re-authenticate every 90 days would cause far too much friction and dropout”.

With that said, as it stands, Dev says that Fidel rarely competes against Open Banking API solutions, as the choice of data source is generally dependent on the specific use case. “Many of our customers are using a combination of the two sources to gather a more holistic view and create better user experiences,” he adds. “So whilst there may be some level of overlaps, account-linking and card-Linking are largely complementary”.

via Startups – TechCrunch https://ift.tt/2n32sLj

Etekcity Stainless Steel Digital Body Weight Bathroom Scale, Step-On Technology, 400 Pounds - CNET

from CNET Smart Home https://ift.tt/351fISo

via IFTTT

5 ways to make Google Home talk nerdy to you - CNET

from CNET Smart Home https://ift.tt/30b4Z8W

via IFTTT

Nintendo Switch Lite teardown reveals modified joystick components

Networking in the cloud remains HPE Aruba's focus

from Latest news https://ift.tt/2lxeFri

via IFTTT

2020 Porsche Taycan first drive review: Breakthrough - Roadshow

from CNET Most Popular Products https://ift.tt/2l2a6Fg

via IFTTT

iPhone 11 Pro and 11 Pro Max review: The iPhone for camera and battery lovers - CNET

from CNET https://ift.tt/2n5E9MX

via IFTTT

'Mario Kart Tour' mobile racing begins at 4AM ET on Android and iOS

Hyperconverged systems revenues reached $1.8 billion in Q2

from Latest news https://ift.tt/2n3hmkS

via IFTTT

Watch an octopus change color while sleeping - CNET

from CNET https://ift.tt/2lwoqG4

via IFTTT

Amazon's Sept. 25 hardware event: rumors of Alexa earbuds, glasses, robots and much more - CNET

from CNET https://ift.tt/2munCBZ

via IFTTT

Passbase grabs $3.6M to power privacy-preserving online ID checks

Digital identity startup Passbase has closed a $3.6 million seed round, led by Cowboy Ventures and Eniac Ventures, with participation from Seedcamp and other European investors.

The 2018 founded startup bagged a $600k pre-seed round earlier this year for its full-stack identity engine with a privacy twist.

The latest tranche of funding will go on growing the team and sales channels in the US and Europe, says co-founder Mathias Klenk. “Our goal is to build an API-first company, so building a strong core organization is key for us to be able to fully focus on securing partnerships with complementary services,” he tells TechCrunch.

“By the end of next year, we aim to have our consumer application rolled out so that individuals can leverage the core value proposition of our service and businesses can reap the rewards of seamless reauthentication,” he adds. In terms of clients, our goal is to move up in scale and conduct pilots with some of the larger players in our target segment.”

Passbase launched an open beta in May and has been running tests over the summer, according to Klenk, who says around 15 companies have been actively testing the platform — claiming 300+ businesses have “expressed interest” in the product.

Earlier testers hail from industries including healthcare, gig economy and mobility, with “exciting use cases in the pipeline from recruitment to financial services that will launch soon”, per Klenk.

What is the product? Passbase dubs it ‘Stripe for identity verification’ — meaning it’s offering APIs to make it easy for developers to plug and integrate a range of consumer-friendly identity checks into their digital services. Such as selfie video scans and identity document scanning. (Passbase is itself plugging into ID document verification services from a range of partners, augmented with add-ons such as a liveness check.)

It touts “NIST-certified facial recognition, forensic ID authenticity analysis, and a patent-pending zero-knowledge sharing architecture” as forming part of its stack.

The overarching goal is to become a trusted intermediary exchange later between businesses and end users — aka a “consent layer” — by building out a developer platform to support the integration of verification technologies into web services, while — on the consumer end — allowing web users to limit who gets access to their actual data. Hence the promise of privacy baked in.

“Our vision is to build out an open identity system that encourages services to hold less information, yet be sure of the quality of the result they are receiving,” adds Klenk.

Consumers can submit personal data to verify their ID, such as a facial biometric scan and identity document scan via their webcam, without having to rely on their data being exposed to and potentially mishandled by non-specialists — instead they have to trust Passbase’s tech architecture.

It also plans to launch a (free) consumer app early next year that will provide end users with controls over the information they’re sharing for ID verification and also serve up insights on how it’s being used — to give people “a holistic view and analytics of their data exposure online”, as Klenk puts it.

Though it won’t be requiring such highly engaged participation from end users — to ‘claim their digital identity’ by downloading its app.

“Our aim is to incorporate your digital identity into the verification flow,” he says, adding: “If you do not care enough about your digital footprint, you do not have to claim your digital identity and can process through a transactional relationship like with any other identity verification provider. However, with a combination of your biometrics and unique identifier, we have the first building blocks of creating a universal digital identity.”

Klenk says he expects access management and account recovery to become an important area for Passbase as — or, well, if — consumers adopt its idea of a “verified digital identity” which they can control.

“In terms of businesses accepting this, of course there are network effects in play,” he goes on. “That being said, identity works as a stack and if we manage to tie the root identity to additional credentials (through partnerships) like background checks, credit scores etc, it would be difficult to pass on using such a system. So at the end of the day, it comes down to who can offer the most full-stack solution.”

There’s plentiful and growing competition in the digital identity management space — including for privacy-protecting sign-ins now Apple has skin in the game — so Passbase certainly has its work cut out to get traction. Though it’s targeting fuller ID checks, arguing that a username and password are inadequate for many of the authentication checks which digital services now demand, given there’s a platforms offering to connect you to pretty much anyone these days, be it a medical professional, babysitter, taxi driver, cleaner, delivery driver or potential life partner.

Klenk says Passbase’s defensibility “comes from the B2B2C approach whereby we are creating a useful service for businesses from day 1, while enabling data ownership for consumers in order to create a more secure and privacy-preserving digital future”.

It does also have patents pending in the US.

“For some of the incumbents in the market, it is complicated to completely shift their business model, whereas for newer competitors, it comes down to the operating model and execution,” he also argues of the competitive landscape.

If Passbase can make their full-stack stick, the plan is to monetize via the developer platform where they’ll offer businesses their first 50 verifications for free.

“Afterwards, our pricing has a platform access fee combined with a per verification cost. The reason being that as we build out more and more modules (ID document verification, phone number, living address, email, work permit) we plan to move towards a SaaS model, offering businesses all kinds of identification services for a predictable cost,” he says. “This is why our pricing also reflects a lower variable cost and increased subscription fee, as volumes grow.”

A self-service b2b product will launch next month — meaning any business will be able to tap Passbase’s APIs and integrate its verification service. The consumer app will naturally follow later.

“For the consumer, the product will always be free as we believe that the data needs to be given back and belong to consumers,” Klenk adds.

via Startups – TechCrunch https://ift.tt/2mzDRNQ

Consumer Data Right ready to be tested ahead of February go-live

from Latest news https://ift.tt/2mzSeBO

via IFTTT

KT and Samsung to apply 5G for 'smart hospital'

from Latest news https://ift.tt/2lml88A

via IFTTT

Boeing to develop AI systems with Defence's autonomous research centre

from Latest news https://ift.tt/2lwGTm2

via IFTTT

Wizards Unite has been updated to 2.4.0 and we can skip catch animations!

We will only give you the major updates, not the bug fixes unless they are Erumpet sized bugs!

Like all Niantic games Harry Potter: Wizards Unite is a living breathing thing that needs constant adjustment and balancing to make keep it enjoyable. As such, the game receives a steady stream of updates to the app to reflect those changes.

A lot of those updates are bugfixes — small changes to address spelling errors or small game issues — but sometimes Niantic makes some serious changes that address major issues in the game. This is where we will record those changes for you to see, and maybe discuss the most important of them.

Version 2.4.0: hurrying us along

-

Encounters: When you successfully cast a spell and return a Foundable, you will now be able to skip through the return animation by tapping on the screen. This will only be possible once you have already returned 1 fragment of a Foundable.

-

Registry: Bogrod the Goblin is now available in Photo Mode.

-

Portrait: You will no longer have to tap each Lens, Frames or Stickers in your Ministry ID Portrait to dismiss the new item badge (red dot).

-

Portkeys: If you open multiple Portkeys at once, you will now only get one dialog box to let you know you have unlocked one or more Portkeys. The Portkey Rewards screen will show even if you're unable to tap 5 Wrackspurts or you leave the Portkey unexpectedly.

-

Ministry ID: Tap and hold Achievement badges in your Ministry ID to get a reminder of which Achievement you completed to receive the badge.

-

Wizarding Challenges: Fixed an issue with Recommended Grade for Chambers being displayed in red text if the player's Grade is equal to the recommended Grade.

This update is full of changes to speed our game up a little it seems. Having all the Portkeys open with one notification is huge if you are like me and try to make them open close to each other and being able to skip the animations when you capture Foundables is going to be so great.

Some of the animations are a lot of fun to watch but really only the first time. The rest of the time they get repetitive. Removing the red dots on screen is another great quality of life change as well, especially if, like me, your camera isn't working and you can't use any of the things that have red dots!

How to update Wizards Unite

Updating an iOS app is easy. Just follow these simple steps.

- Open the App Store app.

- Tap Updates on the bottom of the screen.

-

Tap the Update button next to an app or game that needs to be updated.

The update works similar to downloading a new app or game. It will download and install onto your iPhone. When the installation is complete, you can tap the app or game to open and use it.

Harry Potter accessories we love

Hogwarts phone case

Show your love of the Potterverse, and protect your phone with this beautiful faux-leather case. The Hogwarts crest burns bright on the front with plenty of room inside for some cash and cards too.

RAVPower Ace

You don't want to run out of juice while battling baddies in Fortresses, now do you? Make sure you've got backup power with this quality but inexpensive

Hogwarts House PopSocket

Represent your house with a secure way to grip your phone while walking on your magical adventure casting spells and securing Foundables.

Harry Potter Over The Ear Headphones

Show your love of Harry Potter to the whole world, while shutting that same world out with these funky headphones from ihome.

from iMore - The #1 iPhone, iPad, and iPod touch blog https://ift.tt/2mw49AG

via IFTTT

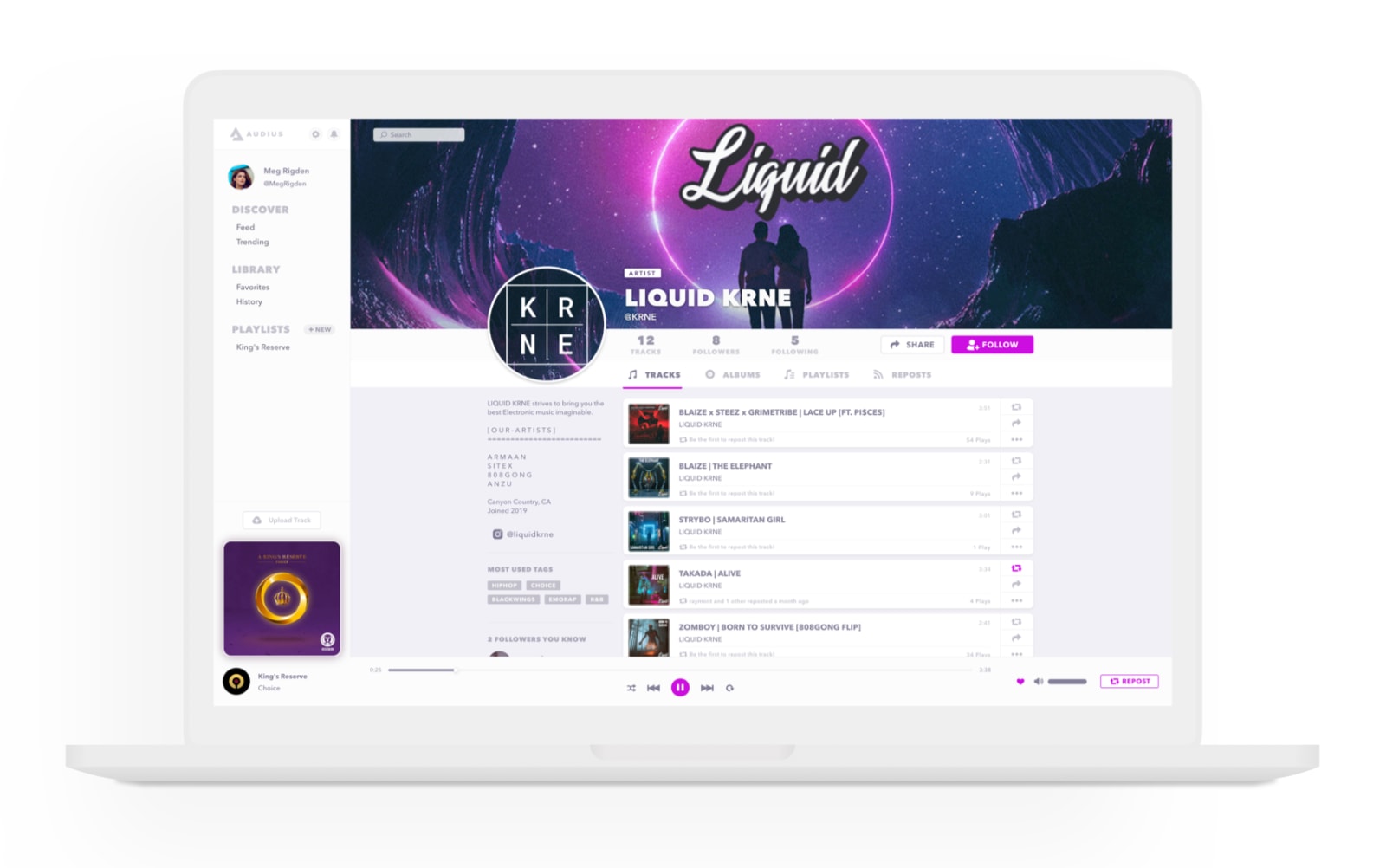

New music platform Audius plans to capitalize on SoundCloud's faults

Ring wanted to use 911 calls for video activation, WeWork CEO steps down video - CNET

from CNET https://ift.tt/2mAAbvf

via IFTTT

Canoo wants to bring this pod-like, subscription-only EV to market in 2021 - Roadshow

from CNET https://ift.tt/2n2svlV

via IFTTT