from CNET https://ift.tt/31Hd0kS

via IFTTT

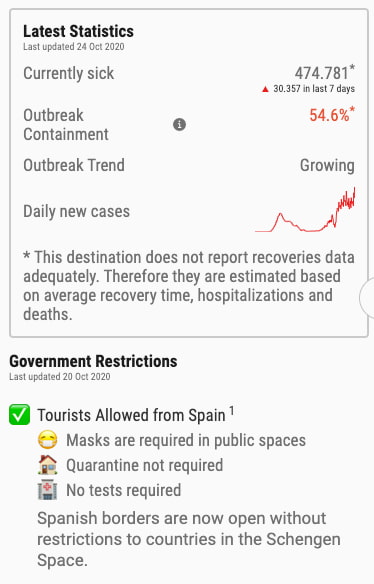

Las complicaciones de decretos, normas y reglamentos han hecho prácticamente imposible la tarea de entender por dónde se puede mover la gente a nivel nacional e internacional mientras dure la pandemia de la Covid-19. Por suerte alguien se ha molestado en resumir todo lo relacionado con los viajes internacionales en una sola página: Covid-19 Travel Restrictions .

El funcionamiento es bastante simple: haciendo un clic se pueden leer las restricciones de cada país en cuanto a entrada y salida. También se puede usar la sección Visualizar por… para ver un resumen de los estados de los confinamientos nacionales y algunos datos estadísticos (muertes por millón de habitantes, incidencia a 7 días, tendencias, etcétera). Informativo pero no tan detallado como las páginas nacionales de cada país, claro.

El funcionamiento es bastante simple: haciendo un clic se pueden leer las restricciones de cada país en cuanto a entrada y salida. También se puede usar la sección Visualizar por… para ver un resumen de los estados de los confinamientos nacionales y algunos datos estadísticos (muertes por millón de habitantes, incidencia a 7 días, tendencias, etcétera). Informativo pero no tan detallado como las páginas nacionales de cada país, claro.

Pero lo mejor es elegir el país de origen (Your Origin/Travel History) para saber a qué países puedes viajar. Se consideran tres opciones: (1) permitido, (2) parcialmente permitido y (3) prohibido con indicadores verde/amarillo/rojo. De este modo desde España a día de hoy vemos que sólo se puede viajar actualmente a 63 países; los otros ~130 están prohibidos o parcialmente prohibidos. Esto incluye Canadá, Estados Unidos, Marruecos, Rusia, Australia, Argentina y muchos otros; en la lista de los «parcialmente prohibidos» están el Reino Unido, Italia, Noruega y China, por nombrar algunos. Todo esto con las excepciones que marcan las normas, claro.

Los datos se actualizan de vez en cuando, cabe suponer que con las fuentes oficiales, así que se entiende que están más o menos al día. De todos modos, de cara a viajar en plena pandemia mundial lo mejor es pensárselo dos veces y en caso de necesidad consultar con las agencias de viajes, compañías aéreas o embajadas.

Relacionado:

Se puede participar hasta el próximo domingo, 13 de diciembre:

Es la tradicional encuesta de la Asociación para la Investigación de Medios de Comunicación (AIMC), también conocida como Navegantes en la Red: Desde su puesta en marcha hace ya 23 años, Navegantes en la red es el más amplio estudio que se realiza en nuestro país para conocer los hábitos y comportamientos de los españoles en la red (…) Este año el estudio incide especialmente en cómo ha afectado la situación actual que vivimos a causa de la COVID-19 y cómo ha repercutido la pandemia tanto en nuestro día a día como en nuestra forma de conectarnos a Internet: situación actual, teletrabajo, 5G, videollamadas o tarifas ilimitadas son algunas de los aspectos sobre los que se pregunta (…) En la web de AIMC se pueden consultar de manera gratuita los estudios de todas sus ediciones anteriores.

Desde su puesta en marcha hace ya 23 años, Navegantes en la red es el más amplio estudio que se realiza en nuestro país para conocer los hábitos y comportamientos de los españoles en la red (…) Este año el estudio incide especialmente en cómo ha afectado la situación actual que vivimos a causa de la COVID-19 y cómo ha repercutido la pandemia tanto en nuestro día a día como en nuestra forma de conectarnos a Internet: situación actual, teletrabajo, 5G, videollamadas o tarifas ilimitadas son algunas de los aspectos sobre los que se pregunta (…) En la web de AIMC se pueden consultar de manera gratuita los estudios de todas sus ediciones anteriores.

Completar el cuestionario requiere entre 15 y 30 minutos. Para compensar un poco el esfuerzo por aportar al bien común algunos datos –de forma anónima– si se facilita un teléfono de contacto al final de la encuesta se puede participar en un sorteo de varios regalos, entre ellos un iPhone 12 o un iPad 2020.

Photo credit should read JUNG YEON-JE/AFP/Getty Images

Photo credit should read JUNG YEON-JE/AFP/Getty Images

Samsung Electronics has announced the death of its chairman, Lee Kun-hee. The company says he died on October 25th with family including his son, vice-chairman Lee Jae-yong, at his side. He was 78.

A cause of death was not given, but Lee had been incapacitated for many years after suffering a heart attack in 2014, causing him to withdraw from public life. Lee Jae-yong, also known as Jay Y. Lee, had been widely assumed to take over upon his father’s passing and has been viewed as the de facto leader in recent years.

Lee Kun-hee was a controversial figure who played a huge part in pushing Samsung from a cheap TV and appliances maker to one of the most powerful technology brands in the world....

This is The TechCrunch Exchange, a newsletter that goes out on Saturdays, based on the column of the same name. You can sign up for the email here.

Back in August during Y Combinator’s two-day demo extravaganza, TechCrunch noted a number of startups from India that stood out from the batch. Names like Bikayi (e-commerce tools), Decentro (consumer banking APIs), Farmako Healthcare (digital health records) and MedPiper Technologies (helping hire health professionals) joined our list of favorites from the batch.

Seeing so many India-focused startups in the mix wasn’t a fluke. Data shows that India’s venture capital scene has grown sharply in recent years. 2019 was the country’s biggest ever in terms of venture dollars invested, with Bain counting $10 billion during the year.

In 2020, the third quarter brought the country’s venture capital scene back to form. After a somewhat average start to the year, Indian startups saw their venture capital investment fall to just $1.5 billion in Q2, the lowest quarterly tally since 2016. But data via KPMG and PitchBook make it plain that Q3 was a rebound, with $3.6 billion invested into Indian startups during the three-month period.

That figure was not a historical record, mind; the Q3 total looks to be only the fourth-biggest VC quarter in India’s startup history since at least 2013 and, perhaps, ever. But it was a good bounce-back during a crippling pandemic all the same. The country’s VC deal count also rebounded a bit in the third quarter, with some of that money landing in big chunks, including a $500 million investment into Byju’s this September.

Smaller startups are also seeing strong results. Bikayi is one such startup. TechCrunch caught up with the company via email, digging into its post-Demo Day results. Its monthly recurring revenue (MRR) grew 60% in August from its July results, it said. And in late August the company told TechCrunch that it was on track to reach $1 million annual recurring revenue (ARR) by the end of the year.

Bikayi said more recently that it recorded 100% growth in the number of merchants it supports, and 100% revenue growth in September. So the WhatsApp-focused Shopify-for-India is racing ahead. October results, Bikayi CEO Sonakshi Nathani added, are looking “promising” as well.

To get a better handle on the Indian startup market more broadly, The Exchange got ahold of Accel investors Arun Mathew (based in the United States), and Prayank Swaroop (based in India), for a bit of digging.

Historically, falling bandwidth and smartphone costs along with improved Internet reliability helped lay the foundation for the recent Indian startup wave, according to Swaroop. Mathew added that some high-profile successes like Flipkart made startups a more attractive option, with the ecommerce company’s success helping to “change the tenor” of the conversation around founding tech firms in recent years.

It also helps, Swaroop added, that seasoned folks from existing Indian tech companies are branching out and starting companies of their own, recycling knowledge into new, smaller companies. This is a key method by which Silicon Valley has managed to create an outsized number of hits over time; a concentration of operators who have built big startups are key grist in the unicorn mill. And there’s more money being raised to help power new Indian tech companies.

All told, 2019 was a huge year for the Indian startup market in venture capital terms, and 2020’s recovery is underway. Let’s see what gets built.

The Exchange spent a lot of this week digging into venture capital data and trends, something that we love to do. If you need to catch up, here’s our look at the U.S. venture capital scene in Q3, and here are our notes on the more global picture. And we touched on India above. What more could there be?

Well, some data on healthcare-focused companies is just what we need. Per a new report from CB Insights, there are 41 healthcare-focused unicorns today. More importantly, startups focused on health-related matters (telemedicine, mental health, AI, etc.) just had a record quarter. Even for a pandemic, $21.8 billion went into the space across 1,539 global rounds in the third quarter. That’s far more activity than I would have guessed.

And with that, we’re cutting Market Notes short this week for some important TechCrunch news:

Hey y’all. It’s Megan Rose Dickey busting into Alex’s newsletter for a couple of quick news items. First, I officially launched my newsletter, Human Capital! It covers labor and diversity and inclusion in tech. Also, I relaunched the Mixtape podcast with my colleague Henry Pickavet. You can check out our first episode of Season 3 about California’s gig worker ballot measure Prop 22 here.

Megan is amazing and you should check out her pod and newsletter.

As always, there was more good stuff to share here than I can possibly fit, so let’s get right into the data, takes, links and other delicacies.

Wrapping, a survey from Salesforce shows that enterprise cloud CEOs are reporting better-than-anticipated revenue growth and lower-than-anticipated churn, when compared to their March estimates. That is probably why earnings haven’t been a disaster and so many unicorns were able to go public in Q3.

That and valuations in the public sphere are higher than what private investors are dishing up, inverting the market’s last few years.

See you Monday,

Editor’s note: Get this free weekly recap of TechCrunch news that any startup can use by email every Saturday morning (7 a.m. PT). Subscribe here.

Startup failure is easy to hold up as a type of martyrdom for progress, especially if the founders are starting out scrappy in the first place and trying to save the world. But heroic narrative gets complicated when the startup failure involves the biggest names in entertainment, dubious product decisions, and well over $1 billion in losses in an already very competitive consumer tech subcategory.

I was going to skip any mention of Quibi because, like me, you have heard more than enough already. But this week its shutdown announcement turned into a debate on Twitter about the nature of startup failure and whether this was still the right kind. Many in the startup world said it was still good, basically because most any ambitious startup effort leads to progress. Danny Crichton, in turn, argues that the negativity was fully justified in this case.

Let’s be honest: Most startups fail. Most ideas turn out wrong. Most entrepreneurs are never going to make it. That doesn’t mean no one should build a startup, or pursue their passions and dreams. When success happens, we like to talk about it, report on it and try to explain why it happens — because ultimately, more entrepreneurial success is good for all of us and helps to drive progress in our world.

But let’s also be clear that there are bad ideas, and then there are flagrantly bad ideas with billions in funding from smart people who otherwise should know better. Quibi wasn’t the spark of the proverbial college dropout with a passion for entertainment trying to invent a new format for mobile phones with ramen money from friends and family. Quibi was run by two of the most powerful and influential executives in the United States today, who raised more money for their project than other female founders have raised collectively this year.

Ouch. However, I think this still misses the bigger dynamic happening.

Quibi was so easy to criticize that it created an opportunity to plausibly defend for anyone who wants to show that they are here for the startups no matter how crazy. When you defend Quibi, you’re defending your own process, and making it clear to the next generation of startups that you’re personally not scared off from other people with crazy ideas and have the will to try even if the result is a big mess. Which is who founders want to hire in the early days, and who investors want to bet on.

I support both sides of this mass-signaling game. Analysts and journalists have provided a broad range of valuable insights about how Quibi was doing it wrong, that are no doubt being internalized by founders of all types. Meanwhile, Quibi defenders are no doubt sorting through their inbound admirers for great new deals. All in all, Quibi and the debate around it might ultimately make future companies a little better. Which is what we all wanted in the first place, right?

Image Credits: Larry Knupp (opens in a new window) / Shutterstock (opens in a new window)

The IPO market has not shut down (yet) for election turmoil and whatnot. First up, managed service provider Datto went out on Wednesday and has inched up since then — a strong outcome for the company and its private equity owner, even if third parties did not benefit from an additional pop. A few more notes from Alex Wilhelm:

Datto’s CEO Tim Weller told TechCrunch in a call that the company will still be well-capitalized after the public offering, saying that it will have a very strong cash position.

The company should have places to deploy its remaining cash. In its S-1 filings, Datto highlighted a COVID-19 tailwind stemming from companies accelerating their digital transformation efforts. TechCrunch asked the company’s CEO whether there was an international component to that story, and whether digital transformation efforts are accelerating globally and not merely domestically. In a good omen for startups not based in the United States, the executive said that they were.

Next to market, Root Insurance released its stock pricing set this week, raising the goal to a valuation above $6 billion. It’s definitely on track to be Ohio’s biggest tech IPO to date. Here’s Alex again, with a comparison against Lemonade, another recently IPOed insurance tech provider for Extra Crunch:

[I]t appears that Root at around $6 billion is cheap compared to Lemonade’s pricing today. So, if you’d like to anticipate that Root raises its IPO price range to bring it closer to the multiples that Lemonade enjoys, feel free as you are probably not wrong. Are we saying that Root will double its valuation to match Lemonade’s current metrics? No. But closing the gap a bit? Sure.

For insurtech startups, even Root’s current pricing is strong. Recall that Root was worth $3.65 billion just last August. At $6.34 billion, the company has appreciated massively in just the last year and change. A small repricing could boost Root’s valuation differential to a flat 100% rather easily.

So, for MetroMile and ClearCover and the rest of the related players, do enjoy these good times as long as they last….

Image Credits: Dong Wenjie (opens in a new window) / Getty Images

A year ago, the market looked quite young. But now, the pandemic has made the value of augmented and virtual reality clearer to the world. Lucas Matney, who has been covering the topic here for years, just conducted a survey of seven top investors in the space. While they mostly continue to see the vertical as a bit early, they see it getting relevant fast. Here’s one key response, from Brianne Kimmel of Work Life Ventures, on Extra Crunch:

Most investors I chat with seem to be long-term bullish on AR, but are reticent to invest in an explicitly AR-focused startup today. What do you want to see before you make a play here?

I think it all comes down to a unique insight and a competitive advantage when it comes to distribution. And so, I’ll use these new [Zoom] apps as an example, I think that they’re a great example where there are certain aspects of roles and certain highly specialized skills where teaching educating and doing your daily job on Zoom won’t actually cut it. I do foresee AR applications becoming an integral part of certain types of work. I also think that now that as a lot of the larger platforms such as Zoom are more open, people will start building on the platforms and there will be AR-specific use cases that can help industries where, you know, a traditional video conferencing experience doesn’t quite cut it.

In other survey news, Mike Butcher continues his (sadly virtual) tour across European startup hubs for EC, this week checking in with investors in Zurich, Switzerland. Here’s a tidy explanation of the city and country’s deep technical experience, from Michael Blank of investiere:

Which industries in your city and region seem well-positioned to thrive, or not, long term? What are companies you are excited about (your portfolio or not), which founders?

Switzerland has always been at the forefront of technological innovation in areas such as precision engineering or life sciences. We strongly believe that Switzerland will also thrive in the long run in those areas. Thinking for example about additive manufacturing startups such as 9T Labs or Scrona, drone companies such as Verity or Wingtra or health tech startups such as Aktiia or Versantis.

Brussels investors, Mike is headed your way next. You can reach him here.

Announcing the agenda for TC Sessions: Space 2020

Rocket Lab’s Peter Beck is coming to TC Sessions: Space 2020

Extra Crunch Partner Perk: Get 6 months free of Zendesk Support and Sales CRM

TechCrunch

Equity Monday: Three neat venture rounds, and Alibaba’s latest

The smart speaker market is expected to grow 21% next year

Financial institutions can support COVID-19 crowdfunding campaigns

Ready Set Raise, an accelerator for women built by women, announces third class

Extra Crunch

Here’s how fast a few dozen startups grew in Q3 2020

Late-stage deals made Q3 2020 a standout VC quarter for US-based startups

Founders don’t need to be full-time to start raising venture capital

Three views on the future of media startups

Dear Sophie: What visa options exist for a grad co-founding a startup?

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast (now on Twitter!), where we unpack the numbers behind the headlines.

Myself, along with Danny and Natasha had a lot to get through, and more to say than expected. A big thanks to Chris for cutting the show down to size.

Now, what did we get to? Aside from a little of everything, we ran through:

Whew! It was a lot, but also very good fun. Look for clips on YouTube if you’d like, and we’ll chat you all next Monday.