ProcessOut has grown quite a lot since I first covered the startup. The company now has a ton of small and big clients, from Glovo to Vente-Privée and Dashlane. The company has become an expert on payment providers and payment analytics.

The core of the product remains the same. Clients sign up to get an overview on the performance of their payment systems. After setting up ProcessOut Telescope, you can monitor payments with expensive fees, failed payments and disappointing payment service providers.

And this product is quite successful. Back in October 2018, the company had monitored $7 billion in transactions since its inception — last month, that number grew to $13 billion.

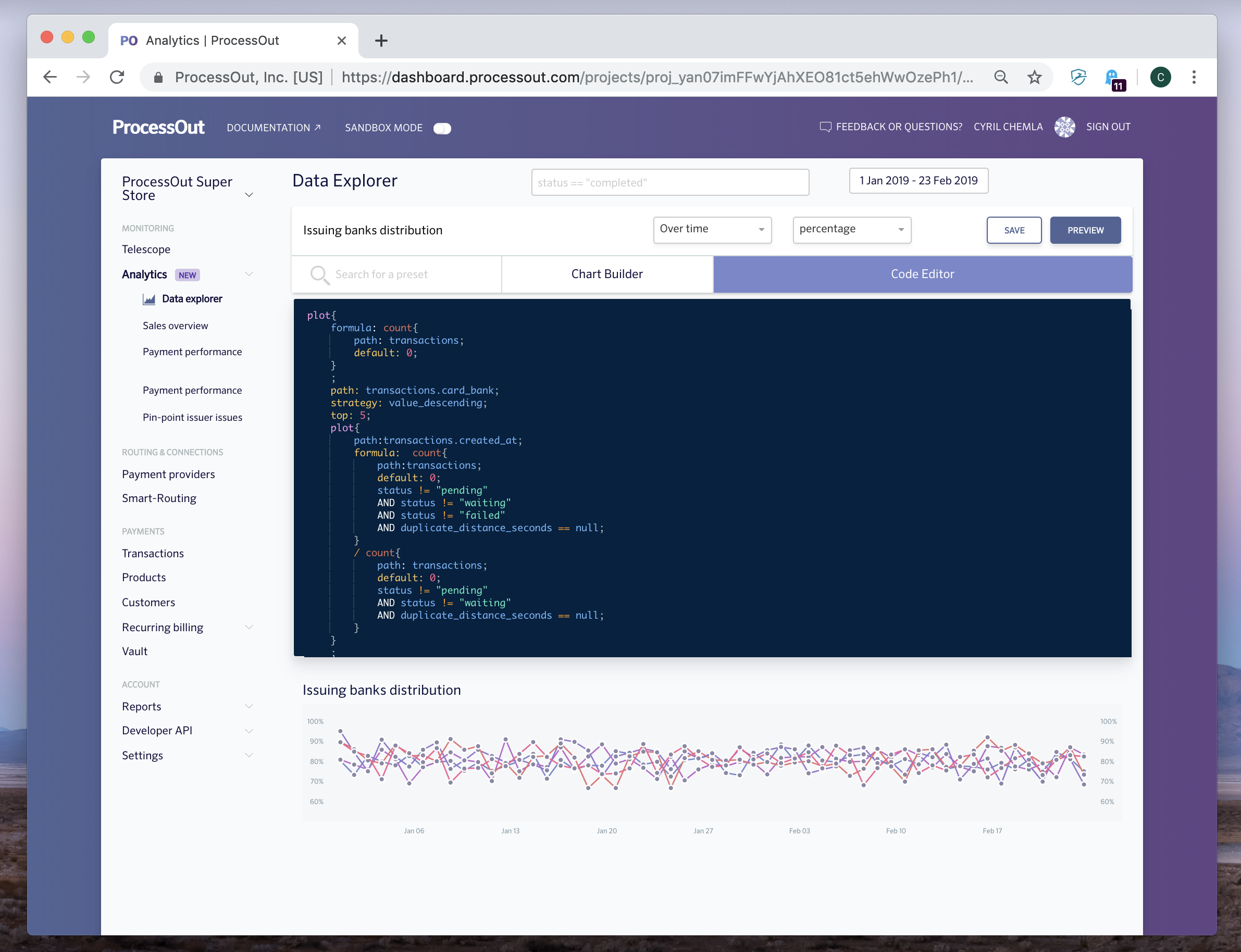

The company is adding new features to make it easier to get insights from your payment data. You can now customize your data visualization dashboards with a custom scripting language called ProcessOut Lang. This way, if you have an internal payment team, they can spot issues more easily.

ProcessOut can also help you when it comes to generating reports. The company can match transactions on your bank account with transactions on different payment providers.

If you’re a smaller company and can’t optimize your payment module yourself, ProcessOut also builds a smart-routing checkout widget. When a customer pays something, the startup automatically matches card information with the best payment service provider for that transaction in particular.

Some providers are quite good at accepting all legit transactions, such as Stripe or Braintree. But they are also more expensive than more traditional payment service providers. ProcessOut can predict if a payment service provider is going to reject this customer before handing the transaction to that partner. It leads to lower fees and a lower rejection rate.

The company recently added support for more payment service providers in Latin America, such as Truevo, AllPago and Mercadopago. And ProcessOut now routes more transactions in one day compared to the entire month of October 2018.

As you can see, the startup is scaling nicely. It will be interesting to keep an eye on it.

via Startups – TechCrunch https://tcrn.ch/2UpeSZ2

No comments:

Post a Comment