Total Pageviews

Friday 31 May 2019

Best TVs: Our top picks, plus plain-language explanations of the most important specs and features

from PCWorld http://bit.ly/2H5clOP

via IFTTT

Samsung Q900 smart TV review: This 8K TV will make you forget all about 4K

from PCWorld http://bit.ly/2JIfvfe

via IFTTT

7 tools to make sense of cord-cutting

from PCWorld http://bit.ly/2KdGI9d

via IFTTT

Amazon’s Echo Show 5 could kneecap the Google Nest Hub

from PCWorld http://bit.ly/2Mh6nk2

via IFTTT

Thursday 30 May 2019

French Rock Star’s Instagram Defeats His Widow in Inheritance Battle

from NYT > Technology https://nyti.ms/2WabtD8

via IFTTT

Pokémon Sleep Wants to Make Snoozing a Game Too

from NYT > Technology https://nyti.ms/30TmPu3

via IFTTT

Your Kids Think You’re Addicted to Your Phone

from NYT > Technology https://nyti.ms/30SNmra

via IFTTT

Amazon Echo stores your voice commands. Here's how Alexa can delete them - CNET

from CNET Smart Home https://cnet.co/2VYwQCn

via IFTTT

Amazon Echo Show 5 vs. Google Nest Hub -- Revenge of Alexa - CNET

from CNET Smart Home https://cnet.co/2IaaXLH

via IFTTT

Amazon's new Alexa features put more emphasis on privacy - CNET

from CNET Smart Home https://cnet.co/2Mgmf6p

via IFTTT

Roomba gets an upgrade and a new floor mopping sidekick - CNET

from CNET Smart Home https://cnet.co/2KbAMh1

via IFTTT

HaoDeng WiFi LED Smart Light 40w Equivalent Multicolor Bulb - CNET

from CNET Smart Home https://cnet.co/2W7B0Nf

via IFTTT

Less than 1 year after launching its corporate card for startups, Brex eyes $2B valuation

Brex, the fintech business that’s taken the startup world by storm with its sought after corporate card tailored for entrepreneurs, is raising millions in Series D funding less than a year after it launched, TechCrunch has learned.

Bloomberg reports Brex is raising at a $2 billion valuation, though sources tell TechCrunch the company is still in negotiations with both new and existing investors. In response to a request for comment, Brex co-founder and chief executive officer Henrique Dubugras told TechCrunch they have no news to announce at this time.

Kleiner Perkins is leading the round via former general partner Mood Rowghani, who left the storied venture capital fund last year to form Bond alongside Mary Meeker and Noah Knauf. As we’ve previously reported, the Bond crew is still in the process of deploying capital from Kleiner’s billion-dollar Digital Growth Fund III, the pool of capital they were responsible for before leaving the firm.

Bond, which recently closed on $1.25 billion for its debut effort and made its first investment, is not participating in the round for Brex, sources confirm to TechCrunch. Bond declined to comment.

Brex, a graduate of Y Combinator’s winter 2017 cohort, has raised $182 million in VC funding, reaching a valuation of $1.1 billion in October 2018 three months after launching its corporate card for startups and less than a year after completing YC’s accelerator program.

Most recently, Brex attracted a $125 million Series C investment led by Greenoaks Capital, DST Global and IVP. The startup is also backed by PayPal founders Peter Thiel and Max Levchin, and VC firms such as Ribbit Capital, Oneway Ventures and Mindset Ventures, according to PitchBook.

The company’s pace of growth is unheard of, even in Silicon Valley where inflated valuations and outsized rounds are the norm. Why? Brex has tapped into a market dominated by legacy players in dire need of technological innovation and, of course, startup founders always need access to credit. That, coupled with the fact that it’s capitalized on YC’s network of hundreds of startup founders — i.e. Brex customers — has accelerated its path to a multi-billion-dollar price tag.

Brex doesn’t require any kind of personal guarantee or security deposit from its customers, allowing founders near-instant access to credit. More importantly, it gives entrepreneurs a credit limit that’s as much as 10 times higher than what they would receive elsewhere.

Investors may also be enticed by the fact the company doesn’t use third-party legacy technology, boasting a software platform that is built from scratch. On top of that, Brex simplifies a lot of the frustrating parts of the corporate expense process by providing companies with a consolidated look at their spending.

“We have a very similar effect of what Stripe had in the beginning, but much faster because Silicon Valley companies are very good at spending money but making money is harder,” Dubugras told me late last year.

Stripe, for context, was founded in 2010. Not until 2014 did the company raise its unicorn round, landing a valuation of $1.75 billion with an $80 million financing. Today, Stripe has raised a total of roughly $1 billion at a valuation north of $20 billion.

Dubugras and Brex co-founder Pedro Franceschi, 23-year-old entrepreneurs, relocated from Brazil to Stanford in the fall of 2016 to attend the university. They dropped out upon getting accepted into YC, which they applied to with a big dreams for a virtual reality startup called Beyond. Beyond quickly became Brex, a name in which Dubugras recently told TechCrunch was chosen because it was one of few four-letter word domains available.

Brex’s funding history

March 2017: Brex graduates Y Combinator

April 2017: $6.5M Series A | $25M valuation

April 2018: $50M Series B | $220M valuation

October 2018: $125M Series C | $1.1B valuation

May 2019: undisclosed Series D | ~$2B valuation

In April, Brex secured a $100 million debt financing from Barclays Investment Bank. At the time, Dubugras told TechCrunch the business would not seek out venture investment in the near future, though he did comment that the debt capital would allow for a significant premium when Brex did indeed decide to raise capital again.

In 2019, Brex has taken steps several steps toward maturation.Recently, it launched a rewards program for customers and closed its first notable acquisition of a blockchain startup called Elph. Shortly after, Brex released its second product, a credit card made specifically for ecommerce companies.

Its upcoming infusion of capital will likely be used to develop payment services tailored to Fortune 500 business, which Dubugras has said is part of Brex’s long term plan to disrupt the entire financial technology space.

via Startups – TechCrunch https://tcrn.ch/2KhPi6Z

Fundraising 101: How to trigger FOMO among VCs

Let’s go beyond the high-level fundraising advice that fills VC blogs. If you have a compelling business and have educated yourself on crafting a pitch deck and getting warm intros to VCs, there are still specific questions about the strategy to follow for your fundraise.

How can you make your round “hot” and trigger a fear of missing out (FOMO) among investors? How can you fundraise faster to reduce the distraction it has on running your business?

“You’re trying to make a market for your equity. In order to make a market you need multiple people lining up at the same time.”

(The three high-profile CEOs who agreed to share their specific playbooks requested anonymity so VCs don’t know which is theirs. I’ve nicknamed them Founder A, Founder B, and Founder C.)

Have additional fundraising tactics to share? Email me at eric.peckham@techcrunch.com.

Table of Contents

- You need to create a market for your shares

- The one month fundraise

- Thursday/Friday meetings

- The bicoastal month

- Early relationship building

- Organize your pitch better

- Research each VC’s style

- You’re not just being judged on your startup

- The money is already yours

You need to create a market for your shares

“You’re trying to make a market for your equity. In order to make a market, you need multiple people lining up at the same time.”

That advice from Atrium CEO Justin Kan (a co-founder of companies like Twitch and former partner at Y Combinator) was reiterated by all the entrepreneurs I interviewed. Fundraising should be a sprint, not a marathon, otherwise the loss of momentum will make it more difficult.

via Startups – TechCrunch https://tcrn.ch/2XgufVY

How we scaled our startup by being remote first

Startups are often associated with the benefits and toys provided in their offices. Foosball tables! Free food! Dog friendly! But what if the future of startups was less about physical office space and more about remote-first work environments? What if, in fact, the most compelling aspect of a startup work environment is that the employees don’t have to go to one?

A remote-first company model has been Seeq’s strategy since our founding in 2013. We have raised $35 million and grown to more than 100 employees around the globe. Remote-first is clearly working for us and may be the best model for other software companies as well.

So, who is Seeq and what’s been the key to making the remote-first model work for us? And why did we do it in the first place?

Seeq is a remote-first startup – i.e. it was founded with the intention of not having a physical headquarters or offices, and still operates that way – that is developing an advanced analytics application that enables process engineers and subject matter experts in oil & gas, pharmaceuticals, utilities, and other process manufacturing industries to investigate and publish insights from the massive amounts of sensor data they generate and store.

To succeed, we needed to build a team quickly with two skill sets: 1) software development expertise, including machine learning, AI, data visualization, open source, agile development processes, cloud, etc. and 2) deep domain expertise in the industries we target.

Which means there is no one location where we can hire all the employees we need: Silicon Valley for software, Houston for oil & gas, New Jersey for fine chemicals, Seattle for cloud expertise, water utilities across the country, and so forth. But being remote-first has made recruiting and hiring these high-demand roles easier much easier than if we were collocated.

Image via Seeq Corporation

Job postings on remote-specific web sites like FlexJobs, Remote.co and Remote OK typically draw hundreds of applicants in a matter of days. This enables Seeq to hire great employees who might not call Seattle, Houston or Silicon Valley home – and is particularly attractive to employees with location-dependent spouses or employees who simply want to work where they want to live.

But a remote-first strategy and hiring quality employees for the skills you need is not enough: succeeding as a remote-first company requires a plan and execution around the “3 C’s of remote-first”.

The three requirements to remote-first success are the three C’s: communication, commitment and culture.

via Startups – TechCrunch https://tcrn.ch/2KhvWyR

CrowdStrike sets terms for $378M Nasdaq IPO

CrowdStrike, in preparation for its Nasdaq initial public offering, has inked plans to sell 18 million shares at between $19 and $23 apiece. At a midpoint price, CrowdStrike will raise $378 million at a valuation north of $4 billion.

The company, which develops cloud-native endpoint protection software to prevent cyber breaches, has raised $480 million in venture capital funding to date from Warburg Pincus, which owns a 30.2% pre-IPO stake, Accel (20.2%) and CapitalG (11.1%), according to its IPO prospectus. The business was valued at $3.3 billion with a $200 million January 2018 Series E funding.

Sunnyvale, Calif.-based CrowdStrike outlined its IPO plans two weeks ago. The company plans to trade under the ticker symbol “CRWD.”

The cybersecurity unicorn follows several other highly valued venture-backed startups to the public markets, including Uber, Lyft, Pinterest, PagerDuty and Zoom. CrowdStrike’s offering will represent only the second cybersecurity IPO in 2019, however. It follows Israel’s Tufin Software Technologies, which went public earlier this year. Last year, for its part, saw the IPOs of Zscaler, Carbon Black and Tenable.

Founded in 2011 by former McAfee executives George Kurtz and Dmitri Alperovitch, CrowdStrike is up against steep competition in the cyber protection space. It’s battling the likes of McAfee, Cylance, Palo Alto Networks, Symantec, Carbon Black and more.

The business’ revenues, fortunately, are growing at an impressive rate, increasing from $53 million in 2017 and $119 million in 2018 to $250 million in the year ending January 31, 2019. In the quarter ending April 30, 2019, its revenues shot up from $47.3 million in 2018 Q1 to between $93.6 million to $95.7 million.

CrowdStrike is also backed by IVP, March Capital Partners, General Atlantic and others.

via Startups – TechCrunch https://tcrn.ch/2XfI6vw

Delane Parnell’s plan to conquer amateur esports

Most of the buzz about esports focuses on high-profile professional teams and audiences watching live streams of those professionals.

What gets ignored is the entire base of amateurs wanting to compete in esports below the professional tier. This is like talking about the NBA and the value of its sponsorships and broadcast rights as if that is the entirety of the basketball market in the US.

Los Angeles-based PlayVS (pronounced “play versus”) wants to become the dominant platform for amateur esports, starting at the high school level. The company raised $46 million last year—its first year operating—with the vision that owning the infrastructure for competitions and expanding it to encompass other social elements of gaming can make it the largest gaming company in the world.

I recently sat down with Founder & CEO Delane Parnell to talk about his company’s formation and growth strategy. Below is the transcript of our conversation (edited for length and clarity):

Founding PlayVS

Eric P: You have a fascinating background as a serial entrepreneur while you were a teenager.

Delane P.: I grew up on the west side of Detroit and started working at the cell phone store of a family friend when I was 13. When I turned 16 or so, I joined two guys in opening our own Metro PCS franchise. And then two additional franchises. And I was on the founding team of a car rental company called Executive Rental Car.

Eric P: And this segued into tech startups after meeting Jon Triest from Ludlow Ventures?

Delane P: He got me a ticket to the Launch conference in SF, and that experience inspired me to start a Fireside Chat series in Detroit that brought in people like Brian Wong from Kiip and Alexis Ohanian from Reddit to speak. Starting at 21, I worked at a venture capital firm called IncWell based in Birmingham, Michigan then joined a startup called Rocket Fiber.

We were focused on internet infrastructure – this is 2015-ish – and I was appointed to lead our strategy in esports. So I met with many of the publishers, ancillary startups, tournament organizers, and OG players and team owners. Through the process, I became passionate about esports and ended up leaving Rocket Fiber to start a Call of Duty team that I quickly sold to TSM.

Eric P: What then drove you to found PlayVS? Did it seem like an obvious opportunity or did it take you a while to figure it out?

Delane P.: What esports means is playing video games competitively bound to governance and a competitive ruleset. As a player, what that experience means is you play on a team, in a position, with a coach, in a season that culminates in some sort of championship.

via Startups – TechCrunch https://tcrn.ch/2XjI4mE

Talkspace picks up $50 million Series D

Talkspace, the platform that lets patients and therapists communicate online, has today announced the close of a $50 million financing round led by Revolution Growth. Existing investors, such as Norwest Venture Partners, Omura Capital, Spark Capital and Compound Ventures, are also participating in the round.

As part of the deal, Revolution Growth’s Patrick Conroy will join the Talkspace board of directors.

Talkspace launched back in 2012 with a mission to make therapy accessible to as many people as possible. The platform allows users to pay a subscription fee for unlimited messaging with one of the company’s 5,000 healthcare professionals. Since launch, Talkspace has rolled out products specific to certain users, such as teenagers or couples.

The company also partners with insurance providers and employers to offer Talkspace services to their members/employees as part of a commercial business. Today, Talkspace has announced a partnership with Optum Health. This expands Talkspace’s commercial reach to 5 million people.

According to the release, Talkspace will use the funding to accelerate the growth of its commercial business.

Here’s what Talkspace CEO and co-founder Oren Frank had to say in a prepared statement:

Our advanced capabilities in data science enable us to not only open access to therapy, but also identify the attributes of successful therapeutic relationships and apply that knowledge throughout the predictive products we build, to the therapists that use our platform, and in the content we provide.

This brings Talkspace’s total funding to $110 million.

via Startups – TechCrunch https://tcrn.ch/2YWMaBn

Stripe and Precursor lead $4.5M seed into media CRM startup Pico

Google and Facebook are increasingly slurping up every ad dollar on the internet. Their dominant position is upending the business models of traditional and startup media companies alike. The click-driven ad model of yore is leaving a graveyard in its wake, as once high-flying companies like Mic collapse.

Learning from the wave of SaaS startups that have launched and gone public over the past decade, media companies are increasingly exploring subscription models as a way to provide robust, recurring revenue while also building closer ties to customers, to boot (btw, have you heard of Extra Crunch?). And customers seem ready to open their wallets, as well.

That transition from ad revenue to subscription means that the infrastructure undergirding these companies needs to be completely ripped out and replaced with new solutions designed to solve a whole new set of problems — and opportunities.

Enter Pico. The brainchild of childhood friends and Stanford grads Nick Chen and Jason Bade, the company wants to imprint a customer-first mentality right into the software powering media companies. At its core, Pico is an identity layer for media — offering a way to implement paywalls, checkouts and analytics while actually knowing who your customers are. Essentially, it’s CRM for media companies, and the company is announcing the product’s general availability today.

That model has also caught the eye of investors. Precursor Ventures and payments processor Stripe are co-leading a $4.5 million seed round into the company, along with Bloomberg Beta, Village Global and Axel Springer Digital Ventures, the German media giant that acquired Business Insider in 2015. Charles Hudson, who was one of the startup’s first investors, will join the board.

Chen explained that there has been a sea change in the media world since the company’s founding in 2016 as PennyPass. Beyond Google and Facebook’s dominance of ad spend, he noted that “the other observation was that, wow, consumers are really ready to pay for content between The New York Times and Netflix and the App Store. This behavior isn’t just music, right? This behavior is now commonplace. So there’s an opportunity for a Cambrian explosion of media entrepreneurs.”

Bade argued that this change opens the opportunity for Pico to insert itself into media infrastructure. “If you’re going to start treating your readers as customers — and not anonymous impressions — [media companies] have to start thinking about a whole different tech stack, which isn’t adtech, which isn’t [Google Analytics] at the anonymized, audience cohort level. But it’s a customer tech stack, it’s marketing funnels, it’s moving people down from the top of the funnel into a payment, and then retention.”

Pico founders Jason Bade and Nick Chen (Photo from Pico)

While there are individual point solutions that may solve each of Pico’s features from payments to email address collection, Chen and Bade are betting that a great out-of-the-box experience with intense focus on conversion and retention can give them a competitive advantage in the marketplace. “When it comes to actually turning on Pico, it’s a matter of minutes. Our whole mantra is we know code,” Chen said. That allows media entrepreneurs to focus on what they do best — producing great content — and allows the Pico team to optimize its product for its customers’ revenue growth and reader satisfaction.

The company’s customer base includes projects funded by the blockchain news network Civil such as the Colorado Sun and Block Club Chicago, as well as niche publications like Teslarati, which obsesses about all things Tesla, and ImpactAlpha, which focuses on the impact-investing world.

Stripe’s investment follows the unicorn’s expanding engagement with the publishing industry. The company publishes Increment magazine, which analyzes engineering issues, and the company has also formed Stripe Press, which produces books on topics broadly in the startup and engineering space.

Pico joins a couple of different companies targeting the next-generation of media companies. For example, Substack, an SF-based startup, focuses on paid email newsletter businesses in the model of Ben Thompson’s Stratechery.

Ultimately, Pico wants to coin its own segment. As Chen explained, “What we see emerging is this product category of ‘audience relationship management.’ We see it as obviously a subcategory of CRM, but it is distinct.” He welcomes competition to the space. “It’s day one of this shift in the industry. And, you know, if it’s as big as we anticipate, there’s going to be a lot more activity in this space in the next few years.”

via Startups – TechCrunch https://tcrn.ch/2MgPTsa

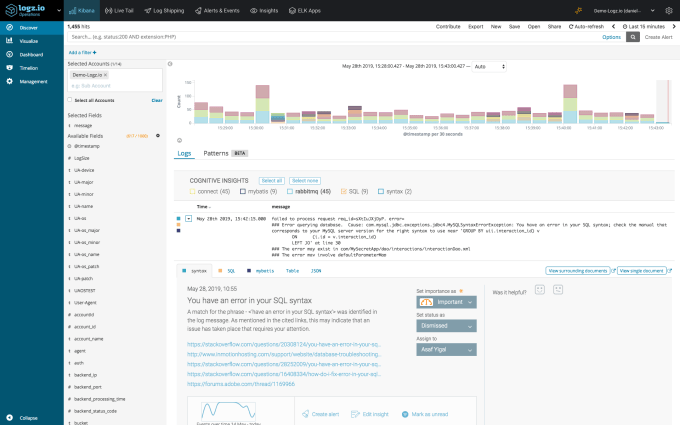

Logz.io lands $52M to keep growing open source-based logging tools

Logz.io announced a $52 million Series D investment today. The round was led by General Catalyst.

Other investors participating in the round included OpenView Ventures, 83North, Giza Venture Capital, Vintage Investment Partners, Greenspring Associates and Next47. Today’s investment brings the total raised to nearly $100 million, according to Crunchbase data.

Logz.io is a company built on top of the open-source tools Elasticsearch, Logstash and Kibana (collectively known by the acronym ELK) and Grafana. It’s taking those tools in a typical open-source business approach, packaging them up and offering them as a service. This approach enables large organizations to take advantage of these tools without having to deal with the raw open-source projects.

The company’s solutions intelligently scan logs looking for anomalies. When it finds them, it surfaces the problem and informs IT or security, depending on the scenario, using a tool like PagerDuty. This area of the market has been dominated in recent years by vendors like Splunk and Sumo Logic, but company founder and CEO Tomer Levy saw a chance to disrupt that space by packaging a set of open-source logging tools that were rapidly increasing in popularity. They believed they could build on that growing popularity, while solving a pain point the founders had actually experienced in previous positions, which is always a good starting point for a startup idea.

Screenshot: Logz.io

“We saw that the majority of the market is actually using open source. So we said, we want to solve this problem, a problem we have faced in the past and didn’t have a solution. What we’re going to do is we’re going to provide you with an easy-to-use cloud service that is offering an open-source compatible solution,” Levy explained. In other words, they wanted to build on that open-source idea, but offer it in a form that was easier to consume.

Larry Bohn, who is leading the investment for General Catalyst, says that his firm liked the idea of a company building on top of open source because it provides a built-in community of developers to drive the startup’s growth — and it appears to be working. “The numbers here were staggering in terms of how quickly people were adopting this and how quickly it was growing. It was very clear to us that the company was enjoying great success without much of a commercial orientation,” Bohn explained.

In fact, Logz.io already has 700 customers, including large names like Schneider Electric, The Economist and British Airways. The company has 175 employees today, but Levy says they expect to grow that by 250 by the end of this year, as they use this money to accelerate their overall growth.

via Startups – TechCrunch https://tcrn.ch/2WdzN6U

Soda Says, a curated consumer electronics retail platform, launches in the US

Grace Gould has spent her life thinking about the intersection of retail and tech. She started out in Apple Retail, and then moved on to Index Ventures where she worked on early-stage investments. She then worked at PCCH International as the VP of Global Retail Strategy, working with companies and hardware makers to develop, manufacture, package and distribute products.

But throughout her career, Gould has always seen a hole in the consumer electronics retail space.

“The interesting thing about consumer electronics is that you have these brands — Apple stores, Microsoft stores, Samsung stores &mdash that sell a very limited number of products,” said Gould. “And then you have big-box retailers like Best Buy. No one is doing an interesting lifestyle business within consumer electronics.”

That’s where Soda Says comes in.

Soda Says is an e-commerce marketplace focused on lifestyle gadgets, such as the Elvie Smart Breast Pump and the Gingko Edge alarm clock.

The company curates useful, aesthetically pleasing gadgets and puts them in categories like Accessories, Wellness, Lifestyle and Kids, with a specific aim to help small hardware companies grow.

Today, Soda Says launches in the United States with a new vertical: women’s sex tech.

As it stands now, there isn’t really a retail experience that makes sense for women’s sex tech. Customers either have to wander into a sex toy store or go for a little internet adventure. But Soda Says is taking an offline approach to this online business, partnering with department stores like Nieman Marcus and Nordstrom to offer pop-up experiences where shoppers already are.

The Sex Tech collection includes products from brands such as Dame, MysteryVibe and Le Wand.

Soda Says operates on a hybrid model, sometimes buying inventory of products for resale and other times simply listing the product on the website.

The company has raised a total of $2.5 million from lead investor, U.K.-based LocalGlobe, with participation from investors including ADV, and founder and CEO of PCH International, Liam Casey, among others.

via Startups – TechCrunch https://tcrn.ch/2XekFmf

San Diego’s eSub raises $12 million for its construction management software

The San Diego-based software developer eSub Construction Software has raised $12 million in a new round of financing for its project management platform for contractors.

The company’s funding was led by Catalyst Investors with participation from previous investor Revolution Ventures.

Software for the construction industry is becoming a big business and attracting more capital from investors. Construction management software vendor Procore is now worth $3 billion, thanks to a $75 million investment late last year from Tiger Global.

Indeed, unicorns are galloping across the construction industry these days. SoftBank kicked off 2018 by investing $865 million in Katerra — one of many early mega-deals from the firm’s giant Vision Fund — which touts itself as a one-stop shop for everything from planning to permitting to filling new building construction. In November, another software developer that was contending for the construction market, PlanGrid, was acquired by Autodesk in an $875 million transaction.

Slotting in the space where project developers outsource to contractors and crews, eSub provides oversight on operations in the field for developers. The company’s software is integrated with its strategic backer, Autodesk, as well as construction estimation and accounting software to provide an overview and budget for the entire construction process from design through the build on-site.

“eSub takes a differentiated approach to solving the needs of the construction industry. By creating an easy-to-use, purpose-built platform, the company empowers trade contractors to have their own system of record and productivity optimization solutions,” said Catalyst partner Susan Bihler. “We’re excited to be part of this next stage of growth.”

Last year, eSub estimates that investors put roughly $3.1 billion in financing into construction technology companies, but the startup maintains that the bulk of those investments overlooked trade contractors, which represent some $1.1 trillion of construction spending.

“Trade contractors are the lifeblood of the construction industry,” said Wendy Rogers, founder and CEO of eSub. “They are the true builders who construct commercial construction projects. However, they are underserved by the majority of disjointed point solutions in the marketplace and are forced to utilize systems that are developed for general contractors.”

via Startups – TechCrunch https://tcrn.ch/2WnAj1N

Agritech startup TaniGroup raises $10M to help Indonesia’s farmers grow

In 2016, former World Bank analyst Eka Pamitra teamed up with five friends to start a business that would help farmers in their native Indonesia. Today their company — TaniGroup — closed a $10 million Series A round that’s aimed at expanding its service nationwide with the support of the government.

TaniGroup works for more than 25,000 farmers in Indonesia to help them get fairer rates for their crops, and grow their businesses. It does that in two ways. It operates a B2B platform that helps farmers sell their produce direct to retailers, which reaches a registered user base of 400 SMEs and 10,000 consumers. The company also manages a microloan fund that grants farmers access to working capital for growth.

TaniHub is the sales service and TaniFund is, as the name suggests, the microloan fund. The fund arrived in 2017 when the product had landed initial traction, and it is registered with the Financial Services Authority (OJK) and is a member of Indonesian Fintech Lenders Association (AFPI).

Pamitra said a combination of factors mean TaniGroup can help farmers grow their overall income by 60% or more. That is driven more by sale volumes than price, the latter of which he said is usually 30-40% higher than traditional reseller channels.

“The most important thing is not necessarily pricing; farmers care more about the certainty of sales,” he explained to TechCrunch in an interview. “Many are afraid to plant too many crops because local aggregators or middlemen don’t have the capacity to absorb everything.”

“The fund focuses on preferred farmers we want to fund to help produce more or release them from the middlemen that currently fund them,” Pamitra added.

While middlemen have a reputation for operating like cartels and adding costs and complications, Pamitra said that in many cases they are actually farmers who help coordinate sales with others. For example, going to other farmers if they need additional produce to fulfill a higher-than-usual order that they can’t complete themselves.

“Some middlemen are the smartest in their group of farmers. We try to empower them through TaniFund; they often start teaching others their tips and can have a positive impact,” he said.

The company plans to spend its new money on general growth, which will include hiring more staff, improving the tech, expanding logistics and upgrading warehouses. That’s much needed since the government has tapped the startup to help improve Indonesia’s farming community — Pamitra said TaniGroup has been given access to government research on farmers that includes a database of some 3 million farmers. (President Joko Widodo previously namechecked the startup as a company that is helping Indonesia’s agricultural industry.)

For now, TaniGroup’s ambitions are firmly focused on Indonesia, but Pamitra said there is a belief that the business can expand overseas. Already it has exported orders to markets like Switzerland, Singapore, Malaysia and beyond, but there is real potential to expand the farmer network into new markets, he said. Officials from the Malaysia government have already expressed interest in making such a move, but Pamitra admitted that “there’s a lot to do here” in Indonesia first.

TaniGroup raised its Series A from Openspace Ventures — which led the round — Intudo Ventures, Golden Gate Ventures and The DFS Lab, a fintech accelerator that’s funded by the Bill and Melinda Gates Foundation. The startup previously raised an undisclosed seed round last April from Alpha JWC Ventures and several angel investors.

via Startups – TechCrunch https://tcrn.ch/2Wd15un

Equalum grabs $18M Series B to help companies ingest data faster

Equalum, an Israeli startup that helps companies gather data from a variety of enterprise sources, announced an $18 million Series B investment today.

The round was led by Planven Investments. Other participants included United Ventures and prior investors Innovation Endeavors and GE Ventures, along with a group of unnamed individuals. Today’s haul brings the total raised to $25 million, according to data provided by the company.

Equalum CEO and founder Nir Livneh says his company essentially acts as the data pipes to feed artificial intelligence, machine and more traditional business intelligence requirements. “Equalum is a real-time data ingestion platform. The idea of the platform is to be able to [gather] data coming from a bunch of enterprise system sources and be able to centralize that data and send it in real-time into analytic environments and feed those analytic environments,” Livneh explained.

He sees the money from this round as a way to continue to expand the original vision he had for the company. His approach in many ways is a classic Series B play. “I think the original thesis was validated. We have proven that we can go into Fortune 100 companies and get our solution adopted quickly,” he said. The next step is to expand beyond the original set of several dozen large customers and accelerate growth.

The company was founded in 2015 in Tel Aviv, Israel. It still maintains its R&D arm there today, with sales, marketing and management in Silicon Valley. Interestingly, its first customer was GE, which was also an early investor via GE Ventures.

Livneh says that he sees lots of room to grow in this market, which he says is still dominated by legacy vendors. He believes he can swoop in and replace aging offerings by providing a more modern and streamlined approach to data collection. Time will tell if he is right.

via Startups – TechCrunch https://tcrn.ch/2WD1KVv

Under-the-radar payments app True Balance just clocked $100M in GMV in India

Away from the limelight of urban cities, where an increasingly growing number of firms are fighting for a piece of India’s digital payments market, a South Korean startup’s app is quietly helping millions of Indians pay digitally and enjoy many financial services for the first time.

The app, called True Balance, began its life as a tool to help users easily find their mobile balance, or topping up pre-pay mobile credit. But in its four-year journey, its ambition has significantly grown beyond that. Today, it serves as a digital wallet app that helps users pay their mobile and electricity bills, and it also lets users pay later.

One thing that has not changed for the parent company of True Balance, BalanceHero, which employs less than 200 people, is its consumer focus. It is strictly catering to people in tier-two and tier-three markets — often dubbed as India 2 and India 3 — who have relatively limited access to the internet, and lower financial power. And it remains operational just in India.

Even as India is already the second largest internet market with more than 500 million users, more than half of its population remains offline. In recent years, the nation has become a battleground for Silicon Valley giants and Chinese firms that are increasingly trying to win existing users and bring the rest of the population online.

And like many other companies, BalanceHero’s bet on India is beginning to pay off. The startup told TechCrunch today that it has clocked $100 million in GMV sales and has amassed about 60 million registered users. Yongsung Yoo, a spokesperson for the startup, added that BalanceHero, which has raised $42 million to date, is also nearing profitability.

The South Korean firm’s playbook is different from many other players that are racing to claim a slice of India’s burgeoning digital payments market. True Balance competes with the likes of Paytm, MobiKwik, Google, Amazon and Walmart-owned Flipkart, though its competitors are still largely catering to the urban parts of India.

In the last two years, many firms have begun to explore smaller cities and towns, but their services are still too out-of-the-world for local residents. Raising awareness about digital services is a big challenge in such markets, Yoo said, so the startup is relying on existing users to help others make their first transactions and in paying bills.

Yoo said the startup rewards these “digital agents” with cash back and other benefits. For these digital agents, many of whom do not have a day job, True Balance has emerged as a side project to make extra money.

Later this year, Yoo said the startup, which recently also added support for UPI in its service, will open an e-commerce store on its app and also offer insurance to users. To accelerate its growth and expansion, True Balance is in the final stages of raising between $50 million to $70 million in a new round that it expects to close in July this year, Yoo said.

via Startups – TechCrunch https://tcrn.ch/2Mfk9n0

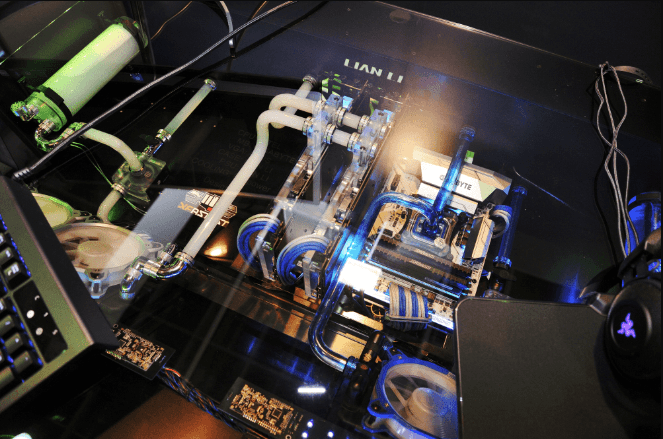

Lian Li’s DK-05 is a standing desk with a cool twist

Even before Computex officially started yesterday in Taipei, Lian Li’s combination chassis and standing workstations were already turning heads as attendees got to take a look at their interiors before the glass tops were installed. The insides of the DK-05 were clearly visible, looking like miniature water parks with a labyrinthine arrangement of tubes and lights.

The desks’ interiors aren’t completely obscured once the top is in place. Their tempered glass tops are foggy when the workstations are turned off, but once switched on, everything inside — its liquid cooling system, motherboards, graphics cards, fans, reservoirs, pumps and whatever else else you add — are clearly visible. The bright lights inside Nangang Exhibition Center made it hard to see, but the photo above from Lian Li’s website gives you a better idea of the full effect.

The larger DK-05 has USB 3.1 Type-C, USB 3.0 and HDMI ports and a 140 cm by 78 cm surface, making space for two monitors and plenty of peripherals (though you probably won’t want to cover it up). It boasts space for two extended ATX motherboards and a motorized height adjustment feature that takes it from 69 to 118 cm. You can preset four heights, useful if more than one person is using the workstation (and with a price tag of about $1,999, it makes sense to share). A smaller version, the DK-04, costs about $1,300.

via Startups – TechCrunch https://tcrn.ch/2QxNkjE

Kustomer raises $40M more led by Tiger Global for its omnichannel approach to CRM

On the heels of customer service company Zendesk announcing an acquisition to expand its omnichannel offering, one of the upstarts nipping at its heels has announced a round of funding to continue growing its own platform.

Kustomer, a customer service startup that calls in data from multiple external channels and the software and apps that a company uses to manage its business internally and speak to customers externally, has raised a Series D of $40 million, led by Tiger Global, with participation from previous investor Battery Ventures. The plan will be to bring in more automation and AI processes to reduce more of the repetitive tasks around CRM — a move specifically aimed to help it target large enterprise customers — and to expand further into Europe, CEO Brad Birnbaum said in an interview.

The valuation is not being disclosed with this round, although Birnbaum noted that it is a “very significant uplift” on its previous valuation. PitchBook, as one data point, notes that in its Series B, it was valued at around $121 million post-money. Adding another $75 million to that (Series C and D together), it’s close to $200 million, although that’s likely lower than its actual valuation now, given that uplift. It has raised just under $114 million to date.

More tellingly, Kustomer has been on a fundraising tear in the last 12 months. It was just in January of this year that it announced a Series C of $35 million. Before that, in June 2018, it raised $26 million. (It was not on the hunt to raise another round so soon, and didn’t need the funding immediately, but it was approached by Tiger with an offer Kustomer did not want to pass up.)

In that time, Birnbaum — who co-founded the startup with Jeremy Suriel in 2015 — has told me multiple times about how Kustomer was increasingly winning more clients off Salesforce and Zendesk, with revenues growing by about 350% in the process, with customers including Ring, Rent the Runway, Glossier, Away, Glovo, Slice and UNTUCKit.

So you might guess that Kustomer’s traction, along with a general swing in terms of what enterprises are looking for in a customer service solution, has had something to do with Zendesk’s own turn toward a more omnichannel approach.

Birnbaum and Suriel know something about how the bigger incumbents work — a previous startup they had worked on together, Assistly (where Birnbaum had been a founder too), was acquired by Salesforce.

Birnbaum does not shy away from talking about how Kustomer is faring against competitors, or why its platform is better than theirs.

“We are most proud of the fact that we do omnichannel really well. On our platform you have a threaded conversation, whereas on others the same input might resolve in four separate tickets,” he said. “In many ways, from a product perspective, I think Zendesk is chasing us, but our product is about 10 years younger.”

Kustomer’s decision to use some of this latest investment to continue building out its automation and AI capabilities lines up with bigger developments that we have seen in enterprise software. Birnbaum, indeed, describes Kustomer’s automation of routine tasks as “a form of RPA” (robotic process automation, which has been one of the fastest-growing areas in enterprise software). “If you’re a retailer and someone ordered a shirt and it’s too small, through the Kustomer platform you can both take the order but also fix it if it’s not the right size, or take the return, rather than passing the customer on to another department,” he said. “You will start to see more and more of these developments as we continue building a system of record beyond a simple CRM tool.”

The next step, he said, will be building even more tools to understand the customer. “We are not a marketing platform today, but already people are using it that way, for example to find recently unhappy customers to send them offers, or do promotional outreach to those who have dropped off on their purchases.”

In addition to Tiger Global joining as an investor, Wendi Sturgis, the CEO of Yext Europe and chief client officer at Yext, has joined Kustomer’s board of directors.

“Kustomer is one of the fastest-growing startups in its space, and I am pleased to join them on their mission to redefine what it means to truly put the customer first, radically shift the approach to customer management and ultimately manifest this in state-of-the-art marketing automation,” she said in a statement. “Plus, when it comes to leadership teams, I am drawn most to disruptors — but only those with the highest integrity. I could not have chosen better, in coming to work with Brad Birnbaum and the incredible team he has assembled.”

via Startups – TechCrunch https://tcrn.ch/2QudeFc

Roger, the accounting automation tool, raises $7.35M Series A

Roger, an accounting automation tool that runs on top of accounting software to automate various processes, has raised $7.35 million in Series A funding.

Leading the round is QED Investors, with participation from 9Yards, Silicon Valley Bank, Financial Venture Studio and BootstrapLabs. A number of individual investors, including Dan Wernikoff, the former GM of QuickBooks and TurboTax, have also backed the Series A.

Claiming to cut the time businesses spend on day-to-day financial processes by as much as 80%, Roger works on top of existing accounting software to automate financial processes, such as paying bills, approvals, receipt scanning, compliance and bookkeeping. This is achieved via “simple workflows” that the Denmark and U.S.-based company says anyone can set up and manage.

Customers range from small to mid-sized businesses across virtually any industry to bookkeeping and major accounting firms.

“For businesses, we’re cutting down the time you have to spend in your accounting software dramatically, and help you save time and money on your external accountant or allocate resources better in your in-house finance team,” Roger CEO and co-founder Cathrine Andersen tells me. “You’ll be able to scale your accounting department more easily without adding new headcount.”

To achieve this, Roger consists of a simple web and mobile app that scans incoming documents and ensures that they are seen by the correct person within an organisation. That way they can quickly and efficiently get “coded, approved and reconciled.”

“Roger’s workflow builder is almost like a Zapier for accounting, letting business owners and finance departments set up rules to govern all financial flows, so they can lean back and watch their work get done. Accounting without accounting,” says Andersen.

Meanwhile, for the accountants Roger sells into, Andersen says the startup is helping them stay competitive within a new landscape that is seeing automation becoming a major disruptor.

“This does not mean that there will be no accountants left in five years, but it means the industry has to change what services and value they bring to clients and that business models will have to change,” she says. “Any bookkeeper or accounting firm that still spends time on manual processes will likely be faced with questions from their clients and soon a rapidly declining customer base. Clients are starting to see that there are tools out there that can do the grunt work, so why would they pay an hourly fee to do the same thing over and over again every month?”

To that end, Roger generates revenue in a number of ways. Businesses pay the company a flat monthly subscription fee based on how many documents they process. Accountants are charged a base fee per client, and a price per document.

“Over time, monetizing our large transaction volume of payments will be a key driver of revenue along with other business models that double as cool features to help our network of Roger customers and vendors to run healthier businesses,” adds the Roger CEO.

via Startups – TechCrunch https://tcrn.ch/2YSchcH

Twaice picks up backing from Cherry Ventures to help electric vehicles eke out more battery life

Twaice, a Munich-based startup developing “predictive analytics” software to help with battery management in electric vehicles and other devices, has raised €2 million in additional seed funding.

The round is led by Berlin’s Cherry Ventures, with participation by existing investors UVC Partners and Speedinvest. It brings the total raised at seed stage by the nine-month-old company — a spin out of Technical University of Munich (TUM) — to €3.2 million.

Already used in trucks, cars, e-scooters and stationary power storage, the Twaice software creates a “digital twin” of battery systems by utilising sensor data, and physical and data-driven battery models. From here it claims to be able to analyse and make accurate real-time predictions about the “health status” of an energy storage system.

Use-cases include closing the loop between product development and application, as well as new possibilities such as predictive maintenance and extending a product’s warranty.

“Batteries represent 30 to 50% of the electric vehicle costs, but they are complex blackboxes and degrade over lifetime,” Twaice co-founder Dr. Stephan Rohr tells TechCrunch.

“The complexity creates enormous risks and challenges for manufacturers of battery electric vehicles, as they have to test and model the eight to 10 years’ lifetime of a battery in only six to 12 months of testing time. And after the start of production, the users of these batteries have the challenge to understand how the battery is degrading as the impact of operating parameters on the degradation is too complex and no battery ages like another one.”

Enter Twaice’s “digital twin,” which Rohr says is fed time-continuous data from a device’s battery management system to constantly update the virtual model of the battery with regard to its current condition.

“Through an augmentation of empirical-analytical models and machine learning, we are then also able to predict, simulate and optimize each individual battery’s lifetime,” he says.

To that end, Twaice generates revenue via a software-as-a-service model. The young company charges an annual recurring fee per digital twin, which scales based on the number of batteries.

via Startups – TechCrunch https://tcrn.ch/2MfBlcl

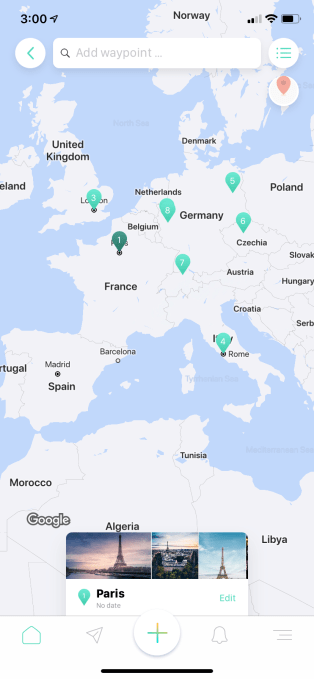

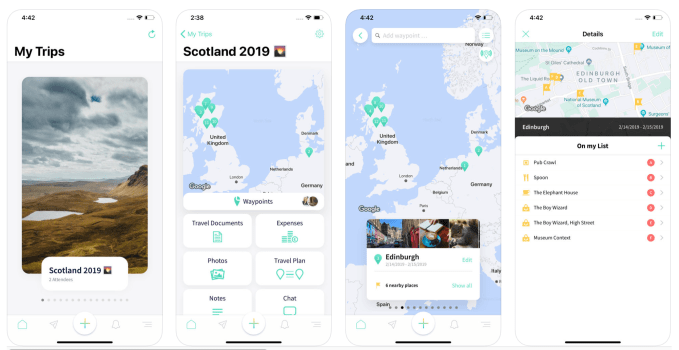

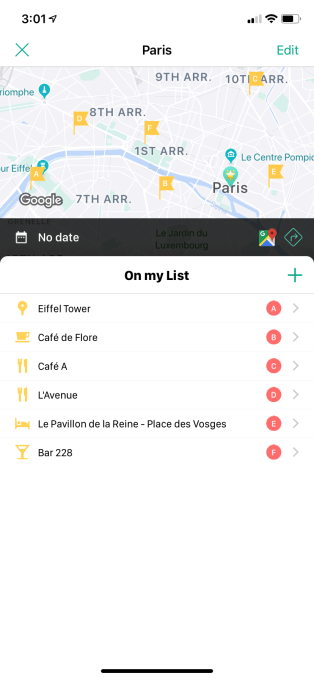

Indie travel app Lambus makes group trip planning easier

There are plenty of travel apps for researching flights and hotels or generally organizing your trips, but indie German developer Hans Knöechel struggled to find one that could gather all his travel-related information in one place, in addition to allowing a group of friends to collaborate on the trip-planning process. So he built one for himself: Lambus, an app that lets you organize your travel documents, manage expenses, plus collaborate and chat with fellow co-travelers about the trip being planned.

Previously a senior software engineer at Appcelerator in San Jose, Knöechel came up with the idea for Lambus after being on the road a lot himself, and finding existing travel apps lacking.

“When traveling, you either use a manual folder with dozens of pages for all your information — or countless apps to display travel expenses, booking confirmations and waypoint planning. Alternatives like Google Trips, Sygic and Roadtrippers were always limited to one person and never offered all the features I needed during the trip,” he explains. “This gave me the idea for Lambus: A collaborative platform on which travel groups — in real-time — can display all the properties of the trip in an easy-to-use platform: Waypoints, travel expenses, booking documents, notes, photos and chat,” he says.

The resulting app he refers to as a “Swiss Army Knife” for travel planning.

Like TripIt and others, travel documents can be shared with Lambus by forwarding emails to a unique personal email address. The imported documents — like plane tickets or Airbnb stays — will then be made available to all group attendees automatically. This is handy for group trips where often multiple people take turns making the various reservations, but don’t have any easy way to share the information with others beyond forwarding emails or writing down information in a shared online document.

Documents can also be uploaded through an “Import PDF” feature, as an alternative to email sharing. And photos can be added by snapping a picture or importing from the phone’s Camera Roll, as well.

The photo feature is handy for saving those miscellaneous pieces of travel information — like how to access an Airbnb upon arrival, travel directions posted on an event or venue’s website, a helpful online review you saved and more. It’s also a fast way to import any other information, without having to rely on email or uploads.

In the expenses section, you can keep track of either private or group expenses by entering the amount and what it was for, and, optionally, if it’s been paid.

While largely aimed at group travel because of the collaboration and built-in chat features, the app can be used for solo trips, too.

In testing the app, we found there were a few kinks that still needed to be corrected.

The calendar, for example, didn’t include the days of the week, only the dates — which was unusual. The app also had trouble finding some points of interest — like a convention center, for example, when it was entered directly in the search box. (It came up when we searched for a “nearby place” to an existing waypoint, oddly.) This appears to be a bug.

Some parts of the German app hadn’t been localized to English, either. For instance, when viewing the detail page for a waypoint, the “On My List” section read: “Noch keine Orte in der Nähe geplant.” (Meaning: “No places planned nearby.”)

More importantly, Lambus didn’t turn imported documents into an easy-to-read itinerary, as TripIt does. The travel plan, instead, included a list of waypoints but not the dates and times, with all the details like flight numbers or hotel reservation numbers. That’s perhaps a deal-breaker in terms of dumping all other travel apps in favor of Lambus alone.

Despite its quirks, the concept here is solid and the app is nicely designed with a bright and clean look-and-feel. The app is only a couple of months old, so given a little more time, attention and a few more releases, it has the potential to become a seriously useful travel tool for group trip planning.

The name, “Lambus,” is an odd choice, we have to also note.

Knöechel says he was searching for a word that was easy to pronounce in many different languages, and settled on this — a domain name he already owned.

While Knöechel is the sole founder, Lambus is a team of seven, including mainly university friends, he says. The startup is seed-funded by the Ministry of Economics in Germany (~€120,000), and eventually has plans to generate affiliate revenue by offering hotel, flight, Airbnb and activity bookings in-app.

Lambus is live on iOS and Google Play.

via Startups – TechCrunch https://tcrn.ch/2KbELdw

Upsie nabs $5M to build a direct-to-consumer warranty service

Warranties for purchased products is a $40 billion annual market. But in their current form, they are considered by some to be one of the bigger scams in the world of retail because they cost so much and often return too little.

Now there is an alternative emerging. A startup out of Minneapolis, Minn. called Upsie has decided to wage war on the old warranty, with more reasonable pricing (typically 70% lower than what the retailer offers) and a much more modern approach to selling and managing the warranty.

Its bet is that lower prices, and more flexible options for ordering, tracking and claiming against warranties, will drive more users to its service and take some business away from the retailers that largely dominate the market today. Today it’s announcing that it has raised $5 million led by True Ventures to build out that business in the U.S. Techstars Ventures, Matchstick Ventures, Syndicate Fund, M25 and angel investor Marc Belton also participated.

If you’ve ever purchased an expensive consumer electronics product, you know the problem that Upsie is tackling: warranties can cost a lot, and in many cases you’re not sure what you might even be getting out of it. And if you do find yourself in the unfortunate predicament of needing to file a claim, you may find the process a little less than efficient, but hopefully not as bad as this:

“If you buy a product worth $900, a warranty might cost an extra $130, but that warranty might cost only $10 from the insurance company,” said Clarence Bethea, the CEO and founder of Upsie.

When an expensive purchase like a consumer electronics product breaks down, the buyer needs to pay out big money for repairs or replacements, and that worry drives many of those customers to pay a big sum for the guarantee that someone else will cover those liabilities.

When an expensive purchase like a consumer electronics product breaks down, the buyer needs to pay out big money for repairs or replacements, and that worry drives many of those customers to pay a big sum for the guarantee that someone else will cover those liabilities.

The operative words in that last paragraph are “big sum”: a warranty can represent peace of mind, and sometimes actually help in those cases where something relatively new does break down, but one of the big issues is the mark-up that providers put on a service that preys on the fear of needing it — in some cases a warranty can cost as much as 900% more than the policy would cost if it were purchased directly from an insurance provider.

Bethea used to be a consultant to big-box retailers and in the work he did, he realised quickly that the retailers were taking advantage of consumers when they were selling warranties on top of products. “Consumers don’t know what the warranties actually cost,” he said. “That’s what pushed me into this.”

Upsie gives consumers the option to purchase warranties up to 60 days after the sale (or 45 for smartphones). The product itself needs a minimum 90-day warranty from the manufacturers themselves, and the Upsie warranty does not kick in until 30 days after it’s purchased — the idea being that it picks up right after the manufacturer warranty ends.

The warranties can be purchased online or through an app and they apply currently to around 15 categories and hundreds of electric goods covering areas like computers, wearables, phones, TVs, small and large appliances and outdoor tools. The Upsie app in itself is like your warranty file in your filing cabinet, except much simpler and lighter and less cluttered: it stores receipts, lets you scan SKUs to register the goods and more to make it easier. Then after a user purchases the warranty, it can be managed and claims can be filed by way of Upsie’s app.

The basic idea behind Upsie is reminiscent of the direct-to-consumer brands that have grown in popularity over the last several years.

Just as these have leveraged the web, mobile apps and more recently social media to build direct relationships with consumers, Upsie is also bypassing retailers and hoping that consumers will consider their cheaper alternatives, which in actuality have been negotiated with the same warranty service providers that the retailers use. It currently works with Centricity, and the plan is to expand it to a wider range over time.

Other companies have built businesses in the area of providing warranty services outside of what retailers offer, such as SquareTrade, which was acquired by AllState, and Asurion. Puneet Agarwal, a partner at True Ventures, believes that it stands out.

“Upsie is the only consumer-facing brand in the space, whereas everyone else is more of a back-end provider,” he said. “Their subscriber growth and engagement are tremendous and the end consumer identifies with them. Because of their direct consumer focus, they also offer a level of pricing, convenience and customer service the industry has not seen.” He added that the “big ambition” is “to make the idea of ‘upsie-ing’ a product as part of the the everyday lexicon of the consumer.”

Bethea said that one of the big early challenges was convincing insurance companies that D2C was a viable idea — which dissipated as insurance companies, like all brands and B2B2C businesses, began to consider the plethora of ways that people are buying goods today, which increasingly extend well outside the realm of just retailers.

The other challenge that is still one that Upsie will continue to work to surmount as it continues growing is convincing consumers to change their behavior. “Initially it was about convincing the industry that this is a market,” he said. “Today it’s awareness and giving consumers another option. ‘I didn’t know I could leave the register and purchase a plan afterwards’ is what we want people to be thinking.”

So far, the results have been pretty positive. Since exiting beta in 2016, Bethea said the company has grown 300% each year. Services are live only in the U.S., and while it works toward expanding to international markets, it will also be adding auto warranties to its plans next.

Living outside of Silicon Valley as I do, companies that are outliers from the normal pattern that often list the same litany of credentials (including but not limited to grads from Stanford or MIT, possible stint at YC, office in San Francisco, past history at other tech companies), but are still thriving, do tend to catch my eye. Upsie, with its roots in the Midwest and an African American founder (also not very common at the typical SV startup), and tackling something that is fundamentally broken but not flashy, ticks some of those boxes.

Turns out that True sees and wants to seek out more of this, too.

“Great companies are being built everywhere,” said Agarwal. “More and more of the companies we invest in are outside of the Valley or are building teams outside of the Valley and we encourage it. It can be a tremendous competitive advantage both from a talent and cost perspective. We have had great success investing in places like Michigan, Montana, Oregon, Wisconsin, Washington, even recently in Africa, and now in Minnesota with Upsie. I still do see a lot of bias from investors not wanting to invest outside of the Valley. There is no question they will miss out not because of high prices in the Valley but because of the opportunity.”

via Startups – TechCrunch https://tcrn.ch/2WrUb3H

VCs give failed AR startup Meta a do-over with new CEO, corporate entity

AR startup Meta’s original investors might have been screwed by the company’s collapse and fire sale, but a pair of VC firms are giving the brand another shot with a new corporate entity and CEO that the new backers hope will lead to a less abysmal outcome.

Meta Company is now Meta View, “a wholly new and unaffiliated entity.”

Meta v1’s not-so-differentiated approach to the AR market led it into trouble competing with teams from Magic Leap and Microsoft that were more focused on new technologies, though Meta was also well-financed with some $73 million in funding raised, according to Crunchbase. The issue came as the company burned through that cash with the expectation that more was on the way. The unexpected dissolution of a $20 million funding round sunk the company and left it scrambling.

Ultimately, the company’s assets were sold months ago — for “less than the bank was owed” — to a mystery buyer that we now know was Olive Tree Ventures.

This isn’t the most conventional investment for Israel-based Olive Tree Ventures. One would imagine a deal like this comes from a specialized investor who finds dead startups, puts a new coat of paint on their IP and attempts to revive old relationships, but Olive Tree is just an early-stage VC firm. The fund generally focuses its investments on Israeli startups, though Meta View will be based in San Mateo, and has traditionally invested in healthtech, something the AR startup was not particularly focused on in its former life.

“We remain extremely bullish on the potential for spatial computing. Our belief was so strong that we did a somewhat non-traditional VC deal to acquire the assets, start a new company and find a new CEO with a vision and focus we believed in,” said Olive Tree Ventures GP Mayer Gniwisch in a statement.

The new company is also launching with an undisclosed amount of funding from Montreal-based BNSG Capital.

It’s not entirely clear what the worth is in so fully reviving the Meta brand, other than scrounging up some faith in the Meta 2 headsets, on which the company staked its reputation. The company will not be selling the Meta 2, but will be supporting previously sold headsets as it works on new hardware.

While this whole situation feels a tad dodgy, the new company’s CEO Jay Wright lends the new venture some credibility. Wright was a co-founder of Vuforia, which really helped blaze a lot of trails in the AR space, and he has led the product at PTC since it was acquired in 2015. Not mentioned in any communications from the new company is the name of Meta’s founding CEO Meron Gribetz, whose role, if any, with Meta View is unclear.

via Startups – TechCrunch https://tcrn.ch/2K6jyBu

Ditch Your Laptop Charger For Anker's Lilliputian PowerPort Atom PD 1, Now Cheaper Than Ever [Exclusive]

I struggle to remember a time that a single-port USB charger generated as much buzz as Anker’s PowerPort Atom PD 1. The tiny, 30W USB-C GaN charger was almost constantly sold out when it came out earlier this year, but now our readers can get it for the best price ever.

via Gizmodo http://bit.ly/2G92qaw

Natural Gas Is Now Called 'Freedom Gas,' According to the Department of Energy

Jingoistic nationalism and promoting fossil fuels go hand in hand for the Trump administration. But the Department of Energy took that connection to a new level on Tuesday with a press release touting natural gas as “freedom gas” full of—I feel stupid even typing this—“molecules of U.S. freedom.” Which I guess means…

via Gizmodo http://bit.ly/2JKHlYs